An Op-Ed in todays News and Observer.

Summary: When the fund sets its own benchmarks, you shouldn't be surprised when it beats them. But compared to the rest of the USA, NC is 43rd (of 47) in terms of performance.

A Finance Professor's blog. I am a Professor of Finance in the Poole College of Management at NC State University. My website: https://sites.google.com/ncsu.edu/warr Opinions are my own.

Wednesday, December 18, 2013

Thursday, December 12, 2013

NC Pension Fund Returns - what is the benchmark?

Ron Elmer has an excellent blog posting showing that although the NC pension fund outperforms its own "custom" benchmark, it has lagged the median return for all public pension funds over 1,2, 5, and 10 years.

In the past year, the fund underperformed by over 2%.

In the past year, the fund underperformed by over 2%.

A couple of observations:

1. The NC Pension Fund benchmark is largely worthless because it changes from year to year and is created by the office that is running the money. As Ron points out, a simple median of all state pension funds makes a lot more sense unless you believe that NC's pension fund is somehow special.

2. The 10 year underperformance is about -0.38%. That gap could be eliminated by just reducing fees. As I've pointed out before, the NC Pension Fund pays way too much in management fees, and lowering those fees by about 1/3 of a percent wouldn't be too hard.

And in case you're wondering, a very back of the envelope computation of 1/3 of a percent over 10 years is about $2 Billion in fees (assuming $60Bn fund value as a rough average over 10 years).

We are bleeding money to Wall Street.

Tuesday, December 10, 2013

Refuting an attack on indexation

Probably the best money management blog out there is Andy Silton's "Meditations on Money Management". Andy is a retired professional, who although in his earlier days was an active manager, now fully subscribes to the notion that you can't beat the market.

Andy's latest post [ here ] - is a rebuttal to a piece in the New York Times profiling Robert Olstein who is an active manager. Olstein lives in a world where anecdotes and stories carry more weight than hard facts and data. This is the world that most active managers live in. They'll claim that of course, most people can't beat the market, but a few can - and they are part of the chosen few. They'll point to a few good years of returns and say "see how I beat the market?"

All active manager's have stories and anecdotes about how they can beat the market, and if you believe them, then you'll hand over your cash and pay the 1% management fee. But if you're smart, you'll index. In the long run you'll be richer - because of the hard facts of the mathematics of finance. No anecdotes needed.

Andy's latest post [ here ] - is a rebuttal to a piece in the New York Times profiling Robert Olstein who is an active manager. Olstein lives in a world where anecdotes and stories carry more weight than hard facts and data. This is the world that most active managers live in. They'll claim that of course, most people can't beat the market, but a few can - and they are part of the chosen few. They'll point to a few good years of returns and say "see how I beat the market?"

All active manager's have stories and anecdotes about how they can beat the market, and if you believe them, then you'll hand over your cash and pay the 1% management fee. But if you're smart, you'll index. In the long run you'll be richer - because of the hard facts of the mathematics of finance. No anecdotes needed.

Wednesday, November 13, 2013

Figure out your retirement number

http://www.thesimpledollar.com/how-to-quickly-figure-out-your-retirement-number/

1. Take your salary

2. * 0.8

3. * 1.03 ^ number of years til you retire

4. - any social security you expect to get

5. * 20.

The answer is how much you need to save. The method is pretty simple but it should give you a ball park idea.

A brief discussion:

Step 2.

The 0.8 is pretty arbitrary - but is trying to get at what amount of your current salary you could live off - hopefully the kids will have left home and your house is paid off. So this number could be 0.7 or less -but don't kid yourself here.

Step 3.

This is to try to get a handle on inflation. Most forecasts (from long term bonds etc) peg inflation as being pretty low in the future. So 3% should take account of any increases in your cost of living.

Step 4.

Social Security. You can got the Social Security website and they'll tell you what your benefit is going to be. http://www.socialsecurity.gov/estimator/

Step 5.

This has nothing to do with you living for 20 years. By multiplying by 20 you are creating a lump sum that could yield 5% income per year that would be enough for you to live on. So this step assumes that you invest your retirement portfolio in an account that earns at least 5%.

If you already have some money saved then you can add the following steps:

6. Take dollar amount you have saved *1.05 ^ number of years.

This will give you an estimate of how much your current money will grow to.

2. Subtract this from the answer from #5 above. This is the new amount you need to save.

3. To find out the amount you need per month, enter this formula in to excel =PMT(0.05/12,12*years,0,amount needed).

This should give you the amount that you need to be saving each month for the rest of your working life assuming 5% return on your investments. Arguably this is a little conservative as your income and amount saved will be going up.

Example:

Salary = 100,000, and 20 years to retire.

$200,000 saved currently.

$1,500 SS benefit per month = 18,000 per year.

Assume investment portfolio earns 5% a year.

80% = 80,000

- 18,000 = 62,000

62,000*1.03^20 = $130,000

130,000*20 = $1.44 Million.

Looking at current save money:

200,000*1.05^20 = 530,000

Amount to save = 1.44 M - 530,000 = 910,000

Using excel formula:

1. Take your salary

2. * 0.8

3. * 1.03 ^ number of years til you retire

4. - any social security you expect to get

5. * 20.

The answer is how much you need to save. The method is pretty simple but it should give you a ball park idea.

A brief discussion:

Step 2.

The 0.8 is pretty arbitrary - but is trying to get at what amount of your current salary you could live off - hopefully the kids will have left home and your house is paid off. So this number could be 0.7 or less -but don't kid yourself here.

Step 3.

This is to try to get a handle on inflation. Most forecasts (from long term bonds etc) peg inflation as being pretty low in the future. So 3% should take account of any increases in your cost of living.

Step 4.

Social Security. You can got the Social Security website and they'll tell you what your benefit is going to be. http://www.socialsecurity.gov/estimator/

Step 5.

This has nothing to do with you living for 20 years. By multiplying by 20 you are creating a lump sum that could yield 5% income per year that would be enough for you to live on. So this step assumes that you invest your retirement portfolio in an account that earns at least 5%.

If you already have some money saved then you can add the following steps:

6. Take dollar amount you have saved *1.05 ^ number of years.

This will give you an estimate of how much your current money will grow to.

2. Subtract this from the answer from #5 above. This is the new amount you need to save.

3. To find out the amount you need per month, enter this formula in to excel =PMT(0.05/12,12*years,0,amount needed).

This should give you the amount that you need to be saving each month for the rest of your working life assuming 5% return on your investments. Arguably this is a little conservative as your income and amount saved will be going up.

Example:

Salary = 100,000, and 20 years to retire.

$200,000 saved currently.

$1,500 SS benefit per month = 18,000 per year.

Assume investment portfolio earns 5% a year.

80% = 80,000

- 18,000 = 62,000

62,000*1.03^20 = $130,000

130,000*20 = $1.44 Million.

Looking at current save money:

200,000*1.05^20 = 530,000

Amount to save = 1.44 M - 530,000 = 910,000

Using excel formula:

=PMT(0.05/12,240,0,910000) = 2,213 per month for the next 20 years (or about 22 % of your gross income).

Tuesday, November 12, 2013

Junk Bonds to fund Noah's Ark?

Unbelievable, but true.

The bonds will have no secondary market, are callable at any point, have no guarantee by the issuer and pay about 5% interest. Oh, and they are going to pay for a museum called "Ark Encounter".

What could go wrong?

The bonds will have no secondary market, are callable at any point, have no guarantee by the issuer and pay about 5% interest. Oh, and they are going to pay for a museum called "Ark Encounter".

What could go wrong?

Masters of Supply Chain and Engineering Management

If you are interested in getting a 1 year masters in Supply Chain with an emphasis on the engineering side of things - check out this new program that is joint with my department and Industrial Engineering at NC State.

Friday, November 8, 2013

Is a PhD important in investment management?

Not surprisingly investment managers with PhDs in Finance outperform those without the degrees. So from an investor's point of view - this might be a reasonable screening tool when evaluating managers.

From a manager's point of view the NPV of a PhD is probably less clear.

From a manager's point of view the NPV of a PhD is probably less clear.

Thursday, November 7, 2013

D'oh! Wrong Tweeter.

Amazingly, people were trading Tweeter Ent Symbol:TWTRQ recently thinking that they were getting a head start on Twitter.

As Finra points out, the Q at the end of the symbol often indicates bankruptcy status. So this isn't the Twitter you are looking for. The stock now trades as THEGQ.

As Finra points out, the Q at the end of the symbol often indicates bankruptcy status. So this isn't the Twitter you are looking for. The stock now trades as THEGQ.

Money left on the table at Twitter.

Twitter [TWTR] went public today. The asking price was $26, but the stock immediately traded up and is now trading at close to $50.

So by my counting, the score card is Twitter 0, IBs and their clients $1.3Bn

So is this good news or bad news?

The answer, of course depends on who you are asking.

From Twitter's point of view, they sold the stock cheap - very cheap. The stock was underpriced by about $45-26 = $19 per share. As they sold about 70 million shares today, the total underpricing was roughly $1.3 Billion. This is sometimes called the "Money left on the table" and by any measure, this is a pretty big sum. Jay Ritter of the University of Florida, keeps track of these things and has a nice summary of past IPO underpricings. In 2012, the total left on the table for all IPOs was about $2.78 Bn, but this is dwarfed by the height of the tech bubble in 1999 when the total was $36 Bn.

From the people who bought the IPO - this turned out great. And we're not talking about people trading the IPO this morning - we're talking about those who were allocated shares by the Investment Banks. These investors saw a huge one day return. But there is a dark side here - as there is plenty of evidence that Investment Banks give allocations of these desirable IPOs to their best clients. So Twitter's shareholders have given up a huge chunk of cash to so that the IBs can provide a nice present to their clients (beats a set of golf clubs or Frozen turkey for Christmas). This practice (giving your clients IPO allocations) is called spinning. Prof Ritter writes about it here.

So by my counting, the score card is Twitter 0, IBs and their clients $1.3Bn

The next question then is how much is TWTR worth?

At $26, twitter has raised about 1.82 Bn. But the company has about 575 million shares outstanding (most of which are not part of the initial IPO. So Twitter has only sold about 12% of the company to the public at this point. The valuation at IPO was about $26*575M = $15Bn. But at the price above, the valuation is closer to $49*575M = $28Bn. It is likely that Twitter will conduct further equity issuances over the coming months, gradually increasing the amount of shares held by the public, and raising more cash as it does.

Finally, what about those traders who bought the IPO at the higher price today?

What does the future hold for them? Of course we can't predict what TWTR stock will do, but the evidence shows that buying an IPO stock at the first day closing price is a terrible investment. On average they underperform the market over the next 3 years by 19% per year. But larger IPOs do fair better, so there may be some hope (Facebook is doing pretty well). That said, I will stick with my Index Funds.

Friday, November 1, 2013

Rising interest rates can hurt alternatives as well...

So says Andy Silton. Alternatives (PE, Hedge funds etc) rely heavily on cheap debt to juice up returns. So it's not just bonds that get hurt in a rising interest rate environment.

Wednesday, October 23, 2013

Mutual Fund trading costs.

An interesting post from Josh Brown. What really caught my eye was this:

Trading costs are too high, too. What comes along with lots of trading is lots of trading costs. Scherrer puts the annual cost at around 1.4% (average) to 2.59% for small cap managers, which really takes a chunk out returns.Remember that when you buy an actively managed fund you are already paying the fund expense ratio which can run 0.5% - 2% depending on the fund. Add to that 2% trading costs and it is amazing that any of these funds ever beat the market.

Monday, October 21, 2013

Monday, October 14, 2013

Nobel Prize for Economics - Fama, Shiller and Hansen

The Nobel prize in Economics was announced today and it goes to Gene Fama, Lars Hansen and Robert Shiller. From a finance perspective this is very big news. But personally - both Fama and Shiller have had a profound impact on my academic career.

Let me talk about Gene Fama (of U. Chicago) first.

Fama is sometimes called the "father of market efficiency". The efficient market theory is one of the most important concepts in finance. Simply stated, it says that all public information is instantly incorporated into stock (or asset) prices. This means that you can't use public information (balance sheets, sales forecasts etc) to forecast stock prices. In essence, if you believe markets are efficient, then you believe that anyone who beats the market is just lucky. Not surprisingly, money managers don't like this.

So, are markets efficient (I am referring to major financial markets)? The answer is a resounding YES. That is why most finance professors are indexers - we don't try to beat the market. We know that chasing abnormal performance is a fool's errand.

I have never met Fama, although I've seen him talk. But in the seven degrees of separation in finance, I know quite a few academics who had Fama as their dissertation chair. Fama's book "Foundation of Finance" is still required reading in many top PhD programs. I still have my copy on my shelf.

Robert Shiller is being pegged as the opposite to Fama by much of the media. This isn't true. What Shiller shows in his research is that markets can deviate from fundamentals - for example - the housing bubble of 2000-2007 and the tech boom of the 1990s. His arguments are brilliantly laid out in the book "Irrational Exuberance". Shiller's work is sometimes called "behavioral finance".

My PhD dissertation at the University of Florida looked at how investors fail to take account of inflation when they value stocks. I showed (with Jay Ritter) that a decline in inflation can lead to a bull market. In 1997 we showed that the market was horribly overvalued (it crashed in 2000). Shiller cited my work in his book "Irrational Exuberance" - I made it into a footnote! I've met Shiller and had dinner with him on a couple of occasions - he's a quiet, mild mannered guy. I am sure that he doesn't disagree with the bulk of Fama's work - but his work shows that while Fama is correct in the short run, in the long run things can get out of line.

Sunday, October 13, 2013

NC Pension Fund bets on Private Equity

An article on Bloomberg.com (also reprinted in the News and Observer) that talks about NC's move into more PE.

I'm quoted in the article stating that I don't think returns for PE will be that great going forward, simply because "everyone and their grandmother" is in the asset class.

I'm quoted in the article stating that I don't think returns for PE will be that great going forward, simply because "everyone and their grandmother" is in the asset class.

Saturday, October 12, 2013

Market manipulation in GTA V

Apparently, some gamers have taken it upon themselves to try to manipulate stock prices in the latest version of "Grand Theft Auto".

While the article is quite interesting, one of the comments is great:

This is solid proof that Grand Theft Auto is harmful and a menace to our society! It doesn't teach people to be murderers, it teaches people to be something far worse: bankers.

HT: Mark (one of my past students).

While the article is quite interesting, one of the comments is great:

This is solid proof that Grand Theft Auto is harmful and a menace to our society! It doesn't teach people to be murderers, it teaches people to be something far worse: bankers.

HT: Mark (one of my past students).

Sunday, October 6, 2013

Saturday, October 5, 2013

No - Twitter has not gone public yet ...

... but that fact didn't stop some investors from trading TWTR (an unrelated penny stock).

See also here.

HT:Mitch (One of my online MBA students).

See also here.

HT:Mitch (One of my online MBA students).

Thursday, October 3, 2013

2/3 of hedge funds are dead.

From the FT via Finance at Tepper - two thirds of hedge funds that are reported in major data sets are dead - they are no longer in existence.

Simple - hedge funds are started all the time. If they get off to a good start and make money they are kept open. But if they don't do well, they are closed down and a new fund is started. Basically, in the hedge fund industry you get unlimited do-overs as long as you can find money to start funds.

How can this be?

Simple - hedge funds are started all the time. If they get off to a good start and make money they are kept open. But if they don't do well, they are closed down and a new fund is started. Basically, in the hedge fund industry you get unlimited do-overs as long as you can find money to start funds.

Finance researchers know of this issue which is why they take special care to control for this "selection bias" when they compute returns. Just looking at the returns of hedge funds in a given year is horribly misleading as these returns are just those of the funds that survived.

A similar thing happens in the mutual fund industry - mutual fund companies start many funds - and hope that some fraction of the funds will do well. The badly performing funds get dumped in target date funds which are then sold to unsophisticated individuals. That's why target date funds are like hotdogs - they are full of the nasty stuff that can't be sold on its own.

Tuesday, October 1, 2013

Tuesday, September 24, 2013

Why is Chrysler filing for an IPO?

A strange situation has developed at Chrysler, where the company has reported that it is filing for an IPO, even though its majority owner, Fiat, is in opposition to the filing.

So what's going on? Back in 2007, the big 3 automakers created something called VEBA -a trust that allowed the firms to transfer their retiree healthcare benefit obligations to the UAW. All was well, until the financial crisis "carpocalypse" and the UAW had to take shares in GM and Chrysler instead of cash because these automakers were broke. Now the UAW wants to cash out, but is unhappy with the price being offered by Fiat - hence the IPO (the VEBA arrangement allows the UAW to push for an IPO). The UAW is hoping that the IPO will result in a higher price than what Fiat is offering.

Fiat isn't happy because a higher valuation will mean that it has to pay more to buy out Chrysler's share of the VEBA fund. But, the UAW could lose out though if the valuation comes in lower.

Either way, Fiat and the UAW are playing chicken. This should be interesting, but there's a good chance this IPO will never happen.

So what's going on? Back in 2007, the big 3 automakers created something called VEBA -a trust that allowed the firms to transfer their retiree healthcare benefit obligations to the UAW. All was well, until the financial crisis "carpocalypse" and the UAW had to take shares in GM and Chrysler instead of cash because these automakers were broke. Now the UAW wants to cash out, but is unhappy with the price being offered by Fiat - hence the IPO (the VEBA arrangement allows the UAW to push for an IPO). The UAW is hoping that the IPO will result in a higher price than what Fiat is offering.

Fiat isn't happy because a higher valuation will mean that it has to pay more to buy out Chrysler's share of the VEBA fund. But, the UAW could lose out though if the valuation comes in lower.

Either way, Fiat and the UAW are playing chicken. This should be interesting, but there's a good chance this IPO will never happen.

Monday, September 23, 2013

The pros can't pick experts either...

I read the headline that billions of dollars is wasted on investment advice and thought - so what's new?

But then I remembered that the vast majority of those in charge of managing money actually think that they can pick winners. They can't - and here's yet more evidence...

http://www.thereformedbroker.com/2013/09/23/dont-feel-bad-the-pros-cant-pick-managers-either/

Here's a link to the research paper.

But then I remembered that the vast majority of those in charge of managing money actually think that they can pick winners. They can't - and here's yet more evidence...

http://www.thereformedbroker.com/2013/09/23/dont-feel-bad-the-pros-cant-pick-managers-either/

Here's a link to the research paper.

Friday, September 20, 2013

How to waste $15 million of the state's money.

Apparently the NC pension fund just put about $1 billion into alternatives. We don't know the fees on these products, but assuming 1.5% (which is roughly what the state pays on similar "investments") the total fees resulting from this move will be about $15 million (and that's just this year).

HT:Ron.

HT:Ron.

Monday, September 9, 2013

Hedge Funds lost money on Nokia.

Apparently many hedge funds lost a lot by betting against Nokia. They weren't counting on MSFT buying the company's handset business.

A few thoughts:

1. Even though hedge funds have the word "hedge" in their title, they frequently don't. It is very common for them to take one way directional bets. The idea that somehow hedge funds are doing something clever and special is just not true.

2. If the hedge funds were trying to hedge, the smart move would have been to be long Nokia and short MSFT. Of course, it's easy to see that after the event -- but that's the point -- predicting the market is a fool's errand.

3. The one thing that hedge funds are good at is getting paid to make these bets. The typical fee structure is 2% of assets under management plus 20% of all gains. A classic heads "I win, tails you loose" fee structure.

A few thoughts:

1. Even though hedge funds have the word "hedge" in their title, they frequently don't. It is very common for them to take one way directional bets. The idea that somehow hedge funds are doing something clever and special is just not true.

2. If the hedge funds were trying to hedge, the smart move would have been to be long Nokia and short MSFT. Of course, it's easy to see that after the event -- but that's the point -- predicting the market is a fool's errand.

3. The one thing that hedge funds are good at is getting paid to make these bets. The typical fee structure is 2% of assets under management plus 20% of all gains. A classic heads "I win, tails you loose" fee structure.

Luck in money management

Great piece on the role of luck in money management.

Bottom line - it is virtually impossible for an individual investor to determine whether an investment manager's performance is due to luck or skill. Yet investors (small and large) continue to line up to pay handsome fees to managers who, as far as we know, just got lucky.

Bottom line - it is virtually impossible for an individual investor to determine whether an investment manager's performance is due to luck or skill. Yet investors (small and large) continue to line up to pay handsome fees to managers who, as far as we know, just got lucky.

Friday, September 6, 2013

Another MOOC - this one is on Pension Fund finance

Here's another MOOC, this time on Pension Fund finance. https://novoed.com/rauh-finance/

Josh Rauh is one of the leading academic researchers in this area. This course should be required for anyone who has any involvement with Pension Funds.

Josh Rauh is one of the leading academic researchers in this area. This course should be required for anyone who has any involvement with Pension Funds.

In which I am on TV talking about the NC Pension Fund

WRAL (our local TV Channel) recently interviewed me for a segment that they did on alternatives in the NC Pension Fund.

The important takeaway is the initial graphic showing the explosion in fees paid by the fund. This is my main concern - as I have said before, fees destroy returns.

The important takeaway is the initial graphic showing the explosion in fees paid by the fund. This is my main concern - as I have said before, fees destroy returns.

Wednesday, September 4, 2013

Asset Pricing MOOC

If you are interested in Asset Pricing (the pricing of financial securities), then you might be interested in a MOOC being taught by John Cochrane of the University of Chicago.

Cochrane is an expert in asset pricing - he wrote the book, actually, a book called "Asset Pricing", he also blogs as the Grumpy Economist.

This is one of the first high level finance MOOCs that I've seen. Be warned though -- the content will be pretty mathematical.

Cochrane is an expert in asset pricing - he wrote the book, actually, a book called "Asset Pricing", he also blogs as the Grumpy Economist.

This is one of the first high level finance MOOCs that I've seen. Be warned though -- the content will be pretty mathematical.

Monday, August 26, 2013

Josh Brown doesn't understand why people invest in Hedge Funds.

And neither do I. Here's Josh's rant - in his classic style he doesn't hold back.

But I fully agree with him, and I even spent time this summer trying to prevent the State of NC from increasing its allocation to Hedge Funds in the State Pension Fund. I testified in front of the House Finance Committee and also met with the Democractic Caucus and Phil Berger (the Senate Leader), but alas to no avail. Ultimately the bill was signed in to law by Governor McCrory. Wall Street Investment managers will be $200 Million per YEAR better off from this bill.

But I fully agree with him, and I even spent time this summer trying to prevent the State of NC from increasing its allocation to Hedge Funds in the State Pension Fund. I testified in front of the House Finance Committee and also met with the Democractic Caucus and Phil Berger (the Senate Leader), but alas to no avail. Ultimately the bill was signed in to law by Governor McCrory. Wall Street Investment managers will be $200 Million per YEAR better off from this bill.

Andy Silton on Money Management Fees.

Great article in the Sunday paper.

As an exercise - take the dollar amount of your 401-K and managed retirement assets and try to figure out what fees you are paying. If, and that's a big if, you can figure this out, think about whether you are getting value for your money.

If you think you are then you are either drinking the Wall Street kool aid, or you are indexing.

As an exercise - take the dollar amount of your 401-K and managed retirement assets and try to figure out what fees you are paying. If, and that's a big if, you can figure this out, think about whether you are getting value for your money.

If you think you are then you are either drinking the Wall Street kool aid, or you are indexing.

Why the CEO matters - Microsoft sheds the Ballmer discount.

Here's a clear indication of how a CEO can make a difference -- by quitting.

Last Friday, Steve Ballmer, CEO of MSFT, announced that he would retire. The market's reaction was pretty unequivocal.

Last Friday, Steve Ballmer, CEO of MSFT, announced that he would retire. The market's reaction was pretty unequivocal.

Wednesday, July 24, 2013

The truth about the NC pension fund's inflation portfolio.

A must read on how the NC Pension Fund is loading up on commodities. These "assets" aren't investments - they are merely directional bets. The new SB 558 would allow $6 bn of these gambles.

Proponents of commodities argue that they are inflation hedges - that they should go up when inflation increases. While many commodities are correlated with inflation, the risk return trade off is frequently terrible. You are getting a bit of diversification at a big overall risk. Top that off with high fees and they are a drag on the overall portfolio.

Surprisingly to many - one of the best inflation hedges are common stocks - but that's a post for another day.

Monday, July 22, 2013

SB 558 will result in a 42% increase in fees to Wall Street

Based on a very thorough analysis which seems pretty reasonable, the revised SB 558 authorizes the Treasurer to increase alternatives to such a degree that fees to Wall Street would go up by 42%.

You can read the full analysis here.

SB 558 is a bad idea - and this isn't a partisan issue. Passing this bill will just waste more millions on bad investments.

Thursday, July 18, 2013

How expensive are alternatives?

My friend Ron took the time to estimate the expense ratio for various asset classes in the NC Retirement System. You can see his excellent full discussion here.

Public equity and bonds are at pretty reasonable rates - 0.46% and 0.01%, although I pay less in my 401-K for my stock portfolio, so I still think 0.46% is pretty high.

But the real shocker is in the alternatives space. Here the fees range from 1.01% to 1.78%! The worst offender being pure "Alternatives" which includes hedge funds. Oh, and this category earned a 5.53% in return.

There is no excuse for this. This is a handout to Wall Street from the tax payers of North Carolina - plain and simple.

Public equity and bonds are at pretty reasonable rates - 0.46% and 0.01%, although I pay less in my 401-K for my stock portfolio, so I still think 0.46% is pretty high.

But the real shocker is in the alternatives space. Here the fees range from 1.01% to 1.78%! The worst offender being pure "Alternatives" which includes hedge funds. Oh, and this category earned a 5.53% in return.

There is no excuse for this. This is a handout to Wall Street from the tax payers of North Carolina - plain and simple.

Wednesday, July 17, 2013

State Pension Fund and my experience with the legislative process.

Today the house finance committee met to discuss the SB 558 which would increase the possible allocation to alternatives for the pension fund. I blogged on this yesterday. A friend and I decided to go downtown to see the action. The bill had been voted on in the senate and had passed almost unanimously. Next it was heading to the house via some potential revisions at the house finance committee. (All this is new to me - but I had a lesson in NC civics this morning!).

I decided to speak up and voice my concern (as a concerned tax payer) that moving to more alternatives will not generate higher returns, but will lead to much higher fees. The vote was close - 14-13 in favor of the bill - and was reported (and tweeted by) Pensions and Investing Magazine.

But all is not lost - I also got to meet some of the Democratic Caucus and (separately) the leader of the Senate - Phil Berger - to express the concerns about these very high fee investments. These products are not a guarantee of higher returns - in fact quite the opposite. Hopefully these folks will be able to stop the passage of this bill.

Anyhow, the legislature session is winding up, so we'll see what happens.

I decided to speak up and voice my concern (as a concerned tax payer) that moving to more alternatives will not generate higher returns, but will lead to much higher fees. The vote was close - 14-13 in favor of the bill - and was reported (and tweeted by) Pensions and Investing Magazine.

#PensionPlans North Carolina takes step closer to higher alternative investment limits http://t.co/yupAk4CKL3

— Pensions&Investments (@pensionsnews) July 17, 2013

But all is not lost - I also got to meet some of the Democratic Caucus and (separately) the leader of the Senate - Phil Berger - to express the concerns about these very high fee investments. These products are not a guarantee of higher returns - in fact quite the opposite. Hopefully these folks will be able to stop the passage of this bill.

Anyhow, the legislature session is winding up, so we'll see what happens.

Tuesday, July 16, 2013

NC Senate Finance Committee to consider Alternative Investments Bill tomorrow.

The proposal by the NC State Treasurer to increase the alternatives allocation in the State Pension Fund continues to make its way through committee. The details of the bill are here. As I've blogged before, this bill allows the State to invest up to 40% in private equity, real estate and hedge funds. Treasurer Cowell, appearing on CNBC, argued that the poor outlook on bonds makes alternatives an attractive option.

I respectfully disagree (and others share my view). Alternatives, and in particular - hedge funds and private equity - are very risky, have very high fees (2% + 20% of all profits is not uncommon), are very illiquid (you can't get your money out), and are very opaque. On top of that there is little evidence that they outperform more conventional investments. Hedge funds rely heavily on borrowed money to boost returns - and thus are also sensitive to interest rate increases that could hurt traditional bond portfolios (a point made by Andy Silton today).

The solution to the State's pension shortfall is to slash the hundreds of millions that it pays to Wall Street managers, and to manage the portfolio in passive manner. This is the only way that will give the Fund a fighting chance of meeting the retirement needs of North Carolina's public employees.

It is worth noting that Ms. Cowell raised the fifth largest campaign fund in the 2012 election. A total over $1 million. What is particularly interesting is that one third of her campaign contributions came from "Lawyers and Lobbyists". Perusing the list of donors is quite enlightening - a great many are from law firms in the north east. This begs the question - "why are New York lawyers funding the State Treasurer race in NC?" I obviously can't comment on anyone's personal motivation, but I will note that investing in hedge funds and private equity is very unlike buying stocks. These investments are very idiosyncratic and require a great deal of legal advice to create the investment contract.

Until recently, investment advisors could make big campaign donations to political campaigns, but the SEC "pay to play" rule took care of that influence. It would seem time for the SEC to expand this ruling to include securities and investment law firms as well.

As I've stated before, this blog represents my personal views and not that of my employer. Furthermore, I write this blog on my own computer at home.

I respectfully disagree (and others share my view). Alternatives, and in particular - hedge funds and private equity - are very risky, have very high fees (2% + 20% of all profits is not uncommon), are very illiquid (you can't get your money out), and are very opaque. On top of that there is little evidence that they outperform more conventional investments. Hedge funds rely heavily on borrowed money to boost returns - and thus are also sensitive to interest rate increases that could hurt traditional bond portfolios (a point made by Andy Silton today).

The solution to the State's pension shortfall is to slash the hundreds of millions that it pays to Wall Street managers, and to manage the portfolio in passive manner. This is the only way that will give the Fund a fighting chance of meeting the retirement needs of North Carolina's public employees.

It is worth noting that Ms. Cowell raised the fifth largest campaign fund in the 2012 election. A total over $1 million. What is particularly interesting is that one third of her campaign contributions came from "Lawyers and Lobbyists". Perusing the list of donors is quite enlightening - a great many are from law firms in the north east. This begs the question - "why are New York lawyers funding the State Treasurer race in NC?" I obviously can't comment on anyone's personal motivation, but I will note that investing in hedge funds and private equity is very unlike buying stocks. These investments are very idiosyncratic and require a great deal of legal advice to create the investment contract.

Until recently, investment advisors could make big campaign donations to political campaigns, but the SEC "pay to play" rule took care of that influence. It would seem time for the SEC to expand this ruling to include securities and investment law firms as well.

As I've stated before, this blog represents my personal views and not that of my employer. Furthermore, I write this blog on my own computer at home.

Thursday, July 11, 2013

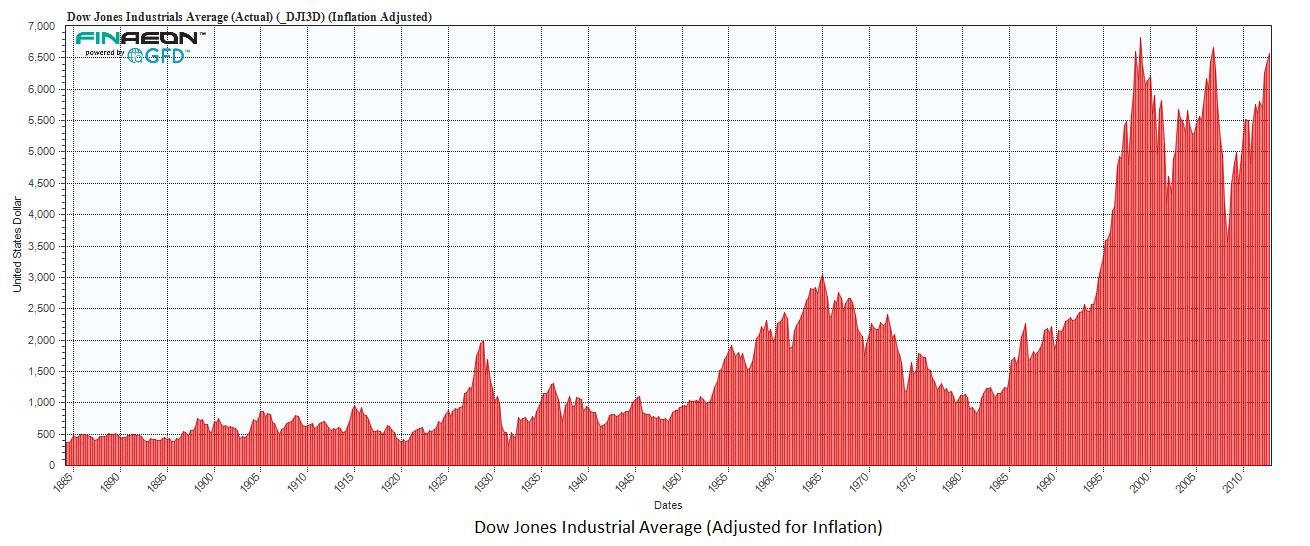

Inflation adjusted Dow

An interesting graphic from "The reformed broker" showing the Dow 30 adjusted for inflation.

In real terms it appears that we haven't made much real progress in recent years - however I would point out that this chart only shows the level of the index (which is a price index only) and thus ignores the rather healthy dividend yield of about 2.5%. So to say that the Dow has not made real gains against inflation would be a bit of a misstatement.

In real terms it appears that we haven't made much real progress in recent years - however I would point out that this chart only shows the level of the index (which is a price index only) and thus ignores the rather healthy dividend yield of about 2.5%. So to say that the Dow has not made real gains against inflation would be a bit of a misstatement.

Tuesday, July 9, 2013

Build a portfolio with three assets.

How to build a stripped down, low cost retirement portfolio that will probably beat more complex investment strategies in the long run.

Sunday, July 7, 2013

NC Pension Fund managers challenge Moody's assumptions...

Moody's has conducted an evaluation of all state pension funds and the good news is that North Carolina's is in better shape than most.

However, the state pension fund is still facing a funding gap - the difference between what the plan owes and what is in the plan.

The question is how big is this funding gap?

The answer is that it depends on who you ask...Moody's claims that the the gap is $7.48bn, while the State of NC reckons that it is around $3.7bn.

This difference in estimates is in part due to how the State and Moody's calculate the present value of the liabilities of the fund. While the State uses the target return of the fund of 7.25%, Moody's uses the rate on risk free securities. By using a lower rate, Moody's computes a larger liability and hence a larger funding gap. I've discussed this issue before.

So who is correct? The State is taking issue with Moody's and correctly argues that they are following the accounting rules. The problem is that it is the rules themselves that are at fault. The liability that the state faces to its retirees is very low risk - it is virtually a certainty. Therefore, this liability should be discounted using a discount rate that reflects this level of risk. 7.25% is far too high, and a more reasonable rate would be the yield on the long term bonds issued by the state which is in the 3.4-4.5% range - this is basically what Moody's used.

By arguing that Moody's estimate is wrong, the State is blurring the real issue.

The article quotes Andy Silton, whose excellent blog is a great resource for anyone interested in state finances.

However, the state pension fund is still facing a funding gap - the difference between what the plan owes and what is in the plan.

The question is how big is this funding gap?

The answer is that it depends on who you ask...Moody's claims that the the gap is $7.48bn, while the State of NC reckons that it is around $3.7bn.

This difference in estimates is in part due to how the State and Moody's calculate the present value of the liabilities of the fund. While the State uses the target return of the fund of 7.25%, Moody's uses the rate on risk free securities. By using a lower rate, Moody's computes a larger liability and hence a larger funding gap. I've discussed this issue before.

So who is correct? The State is taking issue with Moody's and correctly argues that they are following the accounting rules. The problem is that it is the rules themselves that are at fault. The liability that the state faces to its retirees is very low risk - it is virtually a certainty. Therefore, this liability should be discounted using a discount rate that reflects this level of risk. 7.25% is far too high, and a more reasonable rate would be the yield on the long term bonds issued by the state which is in the 3.4-4.5% range - this is basically what Moody's used.

By arguing that Moody's estimate is wrong, the State is blurring the real issue.

The article quotes Andy Silton, whose excellent blog is a great resource for anyone interested in state finances.

Thursday, June 27, 2013

NC Pension wants to increase allocation to alternatives - and why this is a bad idea.

In todays News and Observer it was reported that the State Treasurer, Janet Cowell, is formally requesting that the $80bn state pension fund be allowed to increase its allocation to alternative investments to 40%. (Alternatives are a broad category that includes commodities, private equity and hedge funds).

Ms. Cowell correctly points out that the current return objective of the fund of 7.25% is going to be hard to meet in the current or even foreseeable future given market conditions. A cut of this return objective to 7% would cause the pension fund to be underfunded by $280 Million per year.

The hope is that by increasing the alternatives allocation, the fund can boost returns to cover this shortfall. This is a very risky strategy. First, alternatives are risky - this is the first rule of finance - if you want a higher return, you better be prepared to take more risk. Therefore, this proposal is to increase the risk profile of the fund. Alternatives are good at artificially masking this risk because they are not traded on public exchanges and so we don't get to observe daily price gyrations.

Alternatives are are risky in another way because we don't know what their expected returns should be. Stocks and bonds, for example, while risky, have provided us with a long history of data. Furthermore, their returns can be linked to fundamental measures (such as corporate profits). As a result we can make a reasonable guess at the expected returns on these assets. Figuring out the expected return on alternatives, on the other hand, is a complete shot in the dark. We have no real idea what a hedge fund or private equity fund should return. So making a big bet on alternatives is just that - a big bet.

An alternative to alternatives, is to cut the return assumption of the fund to 7% and then try to come up with the $280 million. This may be actually easier than you'd think. Based on recent numbers, the pension fund incurs over $350 million of fees to outside managers each year. By moving all of the fund into low cost passive investments, the fund could save a large portion of these fees which would then offset the lower return projections. This idea is not quite as crazy as it seems - in fact one municipality in Pennsylvania has done just that.

Ms. Cowell correctly points out that the current return objective of the fund of 7.25% is going to be hard to meet in the current or even foreseeable future given market conditions. A cut of this return objective to 7% would cause the pension fund to be underfunded by $280 Million per year.

The hope is that by increasing the alternatives allocation, the fund can boost returns to cover this shortfall. This is a very risky strategy. First, alternatives are risky - this is the first rule of finance - if you want a higher return, you better be prepared to take more risk. Therefore, this proposal is to increase the risk profile of the fund. Alternatives are good at artificially masking this risk because they are not traded on public exchanges and so we don't get to observe daily price gyrations.

Alternatives are are risky in another way because we don't know what their expected returns should be. Stocks and bonds, for example, while risky, have provided us with a long history of data. Furthermore, their returns can be linked to fundamental measures (such as corporate profits). As a result we can make a reasonable guess at the expected returns on these assets. Figuring out the expected return on alternatives, on the other hand, is a complete shot in the dark. We have no real idea what a hedge fund or private equity fund should return. So making a big bet on alternatives is just that - a big bet.

An alternative to alternatives, is to cut the return assumption of the fund to 7% and then try to come up with the $280 million. This may be actually easier than you'd think. Based on recent numbers, the pension fund incurs over $350 million of fees to outside managers each year. By moving all of the fund into low cost passive investments, the fund could save a large portion of these fees which would then offset the lower return projections. This idea is not quite as crazy as it seems - in fact one municipality in Pennsylvania has done just that.

Wednesday, June 26, 2013

More on Pandora royalties...

David Lowery appears on CNBC.

And Pandora responds

Finally, if you live in Raleigh - Lowery's band - Cracker - will be playing at the Downtown Plaza tomorrow (thursday night). It's a free concert.

And Pandora responds

Finally, if you live in Raleigh - Lowery's band - Cracker - will be playing at the Downtown Plaza tomorrow (thursday night). It's a free concert.

Tuesday, June 25, 2013

1.1 million plays on Pandora equals a $16.89 check to the musician.

A battle is brewing in the online music business - this time Pandora is asking Congress to cut the rate that it has to pay in royalties to the artists who create the music that it streams. This is ticking off a lot of people.

First of all, David Lowery (frontman from Cracker and Camper Van Beethoven a lecturer in Music Business at the University of GA) wrote that out of 1.1 million plays of the Cracker song "Low" in 1 quarter, he got a total of $16.89 in royalties. The band in total got about $42. Similar numbers exist for Spotify and Youtube. As he puts it:

This is already a government mandated subsidy from songwriters and artists to Silicon Valley. Pandora wants to make it even worse. (Yet another reason the government needs to get out of the business of setting webcasting rates and let the market sort it out.)

But Lowery is far from being a lone voice in this issue. The remaining members of Pink Floyd wrote on the USA Today site that:

For almost all working musicians, it's also a question of economic survival. Nearly 90% of the artists who get a check for digital play receive less than $5,000 a year. They cannot afford the 85% pay cut Pandora asked Congress to impose on the music community.

As a rule - when Government sets prices in a market, it is the entity with the greatest lobbying power that gets the best deal. In this case the online music streaming services are successfully using the Government to rip off the people who create the product that they stream.

First of all, David Lowery (frontman from Cracker and Camper Van Beethoven a lecturer in Music Business at the University of GA) wrote that out of 1.1 million plays of the Cracker song "Low" in 1 quarter, he got a total of $16.89 in royalties. The band in total got about $42. Similar numbers exist for Spotify and Youtube. As he puts it:

This is already a government mandated subsidy from songwriters and artists to Silicon Valley. Pandora wants to make it even worse. (Yet another reason the government needs to get out of the business of setting webcasting rates and let the market sort it out.)

But Lowery is far from being a lone voice in this issue. The remaining members of Pink Floyd wrote on the USA Today site that:

For almost all working musicians, it's also a question of economic survival. Nearly 90% of the artists who get a check for digital play receive less than $5,000 a year. They cannot afford the 85% pay cut Pandora asked Congress to impose on the music community.

As a rule - when Government sets prices in a market, it is the entity with the greatest lobbying power that gets the best deal. In this case the online music streaming services are successfully using the Government to rip off the people who create the product that they stream.

Monday, June 24, 2013

Monday, June 3, 2013

Hedge Funds aren't worth the money

Not much of a surprise to me, but apparently a lot of folks still think that Hedge Funds have some kind of magical money making power that also provides downside risk in market downturns.

Actually, come to think of it, Hedge Funds do provide these benefits -- to their managers.

Actually, come to think of it, Hedge Funds do provide these benefits -- to their managers.

Sunday, June 2, 2013

Wednesday, May 29, 2013

NCSU - Poole College of Management #6 in a national ranking.

Yes you read the title right. The Poole College is #6 in the ranking of the best undergrad Operations Management program.

If you're a student or alum - spread the word!

If you're a student or alum - spread the word!

Tuesday, May 21, 2013

Apple wants a tax break...

In my MBA class last night, we talked about corporate tax rates and in particular why some companies don't seem to be paying taxes anywhere close to the listed rate. Case in point, in the most recent year, Apple paid an average tax rate of about 25%, while it is clearly in the 35% bracket. Of course what is happening is that Apple (and many other firms) take advantage of off shore tax shelters. In Apple's case, this is Ireland.

One of my students asked the question - "how is Apple going to get its money back to the US?" and in today's news we have a possible answer - as Tim Cook (Apple CEO) says he'll repatriate these off shore dollars if the US Government taxes them at a single digit rate.

One of my students asked the question - "how is Apple going to get its money back to the US?" and in today's news we have a possible answer - as Tim Cook (Apple CEO) says he'll repatriate these off shore dollars if the US Government taxes them at a single digit rate.

Monday, May 6, 2013

Increasing alternative investments in public pension plans

The NC State legislature is considering increasing the pension fund's allocation to alternatives to 40%. As reported in Pension and Investments magazine, the state is also looking to allow the fund to hold on to assets if they exceed the allocation target. The idea here is to avoid selling assets whose weights have increased because of high performance.

As Andrew Stilton (in his blog) notes, increasing the allocation to alternatives may not be such a great idea.

The problems are pretty simple:

1. Alternatives are very expensive - they have fees that can easily exceed 2%

2. The fee structure is such that you pay higher fees when performance is good, but you don't get a fee refund when performance is bad. From the manager's point of view this is "heads I win, tails you lose".

3. Alternatives are very illiquid.

4. There is no free lunch in terms of performance. To think that you will get higher performance from alternatives without some additional risk is pure folly.

5. Did I mention that these investments are expensive?

I personally think that relying more on alternatives is the wrong approach - a more conservative approach that focuses on traditional assets while paying the lowest fees possible makes more sense.

Underlying this move is a problem that plagues all state pension plans - that the expected return is set too high. Given that long term bond rates are less than 2%, there is little chance that most funds will achieve their return objectives which are typically in the 7-8% range. Of course the other options (higher taxes, higher payroll contributions, lower benefits) are all politically unacceptable. (I've blogged on return assumptions in the past here.)

Incidentally - Stilton's blog "Meditations on Money Management" is excellent - highly recommended.

5/7/13:edited - to note that the legislation hasn't passed the house yet.

As Andrew Stilton (in his blog) notes, increasing the allocation to alternatives may not be such a great idea.

The problems are pretty simple:

1. Alternatives are very expensive - they have fees that can easily exceed 2%

2. The fee structure is such that you pay higher fees when performance is good, but you don't get a fee refund when performance is bad. From the manager's point of view this is "heads I win, tails you lose".

3. Alternatives are very illiquid.

4. There is no free lunch in terms of performance. To think that you will get higher performance from alternatives without some additional risk is pure folly.

5. Did I mention that these investments are expensive?

I personally think that relying more on alternatives is the wrong approach - a more conservative approach that focuses on traditional assets while paying the lowest fees possible makes more sense.

Underlying this move is a problem that plagues all state pension plans - that the expected return is set too high. Given that long term bond rates are less than 2%, there is little chance that most funds will achieve their return objectives which are typically in the 7-8% range. Of course the other options (higher taxes, higher payroll contributions, lower benefits) are all politically unacceptable. (I've blogged on return assumptions in the past here.)

Incidentally - Stilton's blog "Meditations on Money Management" is excellent - highly recommended.

5/7/13:edited - to note that the legislation hasn't passed the house yet.

Twitter hoax flash crash and algorithmic trading?

Was the recent twitter hoax market crash due to algorithmic trading?

More on high frequency trading here, the flash crash and me on the radio talking about it a while ago.

Incidentally - the WSJ "Money Beat" blog aggregation is very good.

More on high frequency trading here, the flash crash and me on the radio talking about it a while ago.

Incidentally - the WSJ "Money Beat" blog aggregation is very good.

Tuesday, April 30, 2013

Optimal Capital Structure and Apple.

Today Apple announced a $17 billion bond issuance to allow it to return capital to shareholders and at the same time increase the firm's leverage. Even with this issuance, AAPL will still have a very low debt to total assets ratio of about 10% based on book values and a mere 4% based on market value.

For most firms, the optimal capital structure (i.e. the blend of debt and equity) is not zero debt. We know this because the Trade-Off theory states that firms should trade off the benefits of debt (interest tax deductibility) against the costs of debt (mainly bankruptcy costs). The optimal capital structure results in the highest firm value because it minimizes the firm's cost of capital. Students of corporate finance should fully understand what is going on here -- we discuss this in great detail in my MBA class.

Clearly AAPL has a way to go before bankruptcy costs loom, but in the meantime the positive stock price reaction observed today confirms that the firm is moving in the right direction.

For most firms, the optimal capital structure (i.e. the blend of debt and equity) is not zero debt. We know this because the Trade-Off theory states that firms should trade off the benefits of debt (interest tax deductibility) against the costs of debt (mainly bankruptcy costs). The optimal capital structure results in the highest firm value because it minimizes the firm's cost of capital. Students of corporate finance should fully understand what is going on here -- we discuss this in great detail in my MBA class.

Clearly AAPL has a way to go before bankruptcy costs loom, but in the meantime the positive stock price reaction observed today confirms that the firm is moving in the right direction.

Friday, April 26, 2013

The retirement gamble

The investorcookbooks blog has an interesting post on a recent Frontline TV documentary called "the Retirement Gamble" The documentary is a must see for anyone saving for retirement - i.e. pretty much everyone.

The take away is: Buy Index Funds and avoid fees. Of course readers of this blog will know that I preach those two ideas every chance I get.

Here's the link to the documentary - you can watch it on your computer.

The take away is: Buy Index Funds and avoid fees. Of course readers of this blog will know that I preach those two ideas every chance I get.

Here's the link to the documentary - you can watch it on your computer.

Thursday, April 25, 2013

A couple on statistics - yes statistics.

First: Nate Silver (the guy who predicted the election) crunches the numbers on the recent senate gun control vote. Of interest to me was that Nate is a Stata guy (you can tell by his output).

Second, Montse Fuentes, Prof of Statistics at NCSU has a column on why statistics is the hot job in this area.

Second, Montse Fuentes, Prof of Statistics at NCSU has a column on why statistics is the hot job in this area.

Tuesday, April 16, 2013

90% Debt, GDP growth and MS Excel errors.

I hadn't been paying that much attention to this, but it turns out that a well cited statistic is that countries that have debt that is 90% of GDP grow slower than lower debt countries. Hence a strong reason for reducing federal debt...or so it would seem...

The original idea was put forward in a paper by two Harvard economists, Carmen Reinhart and Ken Rogoff, and since then it has been very popular with the Tea Party crowd as a reason why federal debt is a "bad thing".

Unfortunately, it turns out that the analysis was wrong. The researchers apparently missed some observations, used a somewhat dubious weighting system and worst of all made a fundamental excel error.

I am not sure what is more shocking, that Harvard economists would make such analysis errors, or that they are actually using Excel as their primary analysis tool.

Full details in the LA Times here, and a more detailed analysis of the errors are here. Both articles are well worth reading.

(Thanks to my colleague Srini for sending me the link)

The original idea was put forward in a paper by two Harvard economists, Carmen Reinhart and Ken Rogoff, and since then it has been very popular with the Tea Party crowd as a reason why federal debt is a "bad thing".

Unfortunately, it turns out that the analysis was wrong. The researchers apparently missed some observations, used a somewhat dubious weighting system and worst of all made a fundamental excel error.

I am not sure what is more shocking, that Harvard economists would make such analysis errors, or that they are actually using Excel as their primary analysis tool.

Full details in the LA Times here, and a more detailed analysis of the errors are here. Both articles are well worth reading.

(Thanks to my colleague Srini for sending me the link)

Thursday, April 11, 2013

"All washes - half price, every day" - JC Penney's failed strategy.

On a recent road trip in my home state of NC, we passed through a small town with a puzzling sign outside of a small laundry. The handwritten sign said:

My first reaction was - what a stupid marketing strategy! Surely customers would see through it. But then I realized that this is exactly the strategy that JC Penney has used for years. The retailer's recent deviation from this strategy led to a near collapse of its stock price and the firing of its CEO.

Read more about why Penney's customers are like laundry customers in rural NC.

All washes - half price, everyday.

My first reaction was - what a stupid marketing strategy! Surely customers would see through it. But then I realized that this is exactly the strategy that JC Penney has used for years. The retailer's recent deviation from this strategy led to a near collapse of its stock price and the firing of its CEO.

Read more about why Penney's customers are like laundry customers in rural NC.

Wednesday, April 10, 2013

Potential, possible, or probable predatory scholarly open-access journals

Of interest to academics: It turns out that there is a who industry of less than reputable journals that are all about making money and will take any research (even plagiarized work). An example is given here.

And here is a full list of potentially dubious journals.

And here is a full list of potentially dubious journals.

The pension rate of return fantasy.

Yet another article on why most state pension funds are living in a fantasy world where a mixed portfolio is expected to return 8%.

I posted on this a while ago.

I posted on this a while ago.

Social security should be indexed to Chained CPI.

The difference between different inflation measures didn't seem too important to most people, until the President unveiled his budget which proposes to link Social Security (among other things) to something called "Chained CPI". This seems like some arcane adjustment, but in fact it is very important.

Background: We frequently refer to the change in CPI (consumer price index) as being the rate of inflation - but in reality it is merely one way of estimating the rate of inflation. The CPI-U (U refers to urban consumers) measures the price level of a representative basket of goods. The problem with the CPI-U is that it doesn't account for substitutions of one item for another. For example, this week apples are expensive, but bananas are not, so a consumer may switch between the two. If the price index is measuring the cost of living, then it makes sense to include these substitutions. This is what the Chained CPI does.

The President's proposal is to link increases in Social Security benefits to this Chained CPI measure. Because the Chained CPI doesn't increase quite as fast as the non-chained CPI which is currently being used, the net result is that Social Security benefits won't increase as rapidly.

In the short run, there won't be much of a difference, but in the long run the difference will be far more noticeable. Not surprisingly, many advocates for seniors are complaining that this amounts to a reduction in benefits. While technically correct, the fundamental question is what are the benefits that Social Security recipients are entitled to?

As The Economist explains, by indexing Social Security to the ordinary CPI, retirees have, in effect, been getting a real increase in their benefits (note that the word "real" means an increase above the rate of inflation). Even if we were to link Social Security to an index that tracks a basket of expenditures that are more typical of retirees, the rate of increase would still be less.

Given that we're facing an ever increasing federal debt, this seems like a reasonable and fair way of tackling at least part of the problem. It is also worth noting that by not dealing with this problem, the children and grandchildren of today's retirees will most certainly be paying more in taxes and getting less in benefits.

Background: We frequently refer to the change in CPI (consumer price index) as being the rate of inflation - but in reality it is merely one way of estimating the rate of inflation. The CPI-U (U refers to urban consumers) measures the price level of a representative basket of goods. The problem with the CPI-U is that it doesn't account for substitutions of one item for another. For example, this week apples are expensive, but bananas are not, so a consumer may switch between the two. If the price index is measuring the cost of living, then it makes sense to include these substitutions. This is what the Chained CPI does.

The President's proposal is to link increases in Social Security benefits to this Chained CPI measure. Because the Chained CPI doesn't increase quite as fast as the non-chained CPI which is currently being used, the net result is that Social Security benefits won't increase as rapidly.

In the short run, there won't be much of a difference, but in the long run the difference will be far more noticeable. Not surprisingly, many advocates for seniors are complaining that this amounts to a reduction in benefits. While technically correct, the fundamental question is what are the benefits that Social Security recipients are entitled to?

As The Economist explains, by indexing Social Security to the ordinary CPI, retirees have, in effect, been getting a real increase in their benefits (note that the word "real" means an increase above the rate of inflation). Even if we were to link Social Security to an index that tracks a basket of expenditures that are more typical of retirees, the rate of increase would still be less.

Given that we're facing an ever increasing federal debt, this seems like a reasonable and fair way of tackling at least part of the problem. It is also worth noting that by not dealing with this problem, the children and grandchildren of today's retirees will most certainly be paying more in taxes and getting less in benefits.

Sunday, April 7, 2013

How not to market time, and why the EMH isn't a cult.

A student forwarded me this link about the market timing escapades of a couple of individual investors. Unfortunately the two individuals sold when the market collapsed and then bought back in only after the market had been rising for a while. Buy high and sell low is not a good trading strategy.

I agree with the author of the article that there are probably many people who are timing the market this way, and suffering the disastrous financial consequences. But then the author surprised me and went in a completely different direction.

He argues, that the problem is partly due to:

Although it sounds easy, this isvery hard impossible to do. For example, today the market is doing really well. Are people greedy today? Maybe, but if I sell today and the market goes up another 20%, then I have lost out big time. What if the market falls 10% tomorrow? Are people fearful then? Is that a buying opportunity? What happens if the following it falls another 20% after I bought in?

It is easy after the event to see when we should have bought and sold, but at any given point in time, we cannot know what the market will do tomorrow or in 6 months time. This is what the Efficient Markets Hypothesis states. It doesn't not state the prices are not important. Far from it, it states that prices incorporate all past information, but they don't tell us anything about the future. There is no EMH cult, and to say that EMH is nonsense is just silly - the evidence supporting the EMH is vast and very robust.

As always, the conclusion is the same. You cannot reliably predict future prices and you cannot time the market. The only solution for individual investors (or any investors) is to pick a risk level that you are comfortable with and then ride the ups and downs of the market. In the end you'll come out ahead.

HT: John.

I agree with the author of the article that there are probably many people who are timing the market this way, and suffering the disastrous financial consequences. But then the author surprised me and went in a completely different direction.

He argues, that the problem is partly due to:

"...the spreading influence of a cult called the Efficient Market Hypothesis, which downplays the importance of the actual price you pay for stocks. It is horrifying how many financial advisers have bought into the nonsense of the EMH, often without even understanding it."The author states that what investors should do is buy low and sell high. And the way to figure out when these times are is to follow the old Warren Buffet adage of buying when others are fearful and selling when others are greedy.

Although it sounds easy, this is

It is easy after the event to see when we should have bought and sold, but at any given point in time, we cannot know what the market will do tomorrow or in 6 months time. This is what the Efficient Markets Hypothesis states. It doesn't not state the prices are not important. Far from it, it states that prices incorporate all past information, but they don't tell us anything about the future. There is no EMH cult, and to say that EMH is nonsense is just silly - the evidence supporting the EMH is vast and very robust.

As always, the conclusion is the same. You cannot reliably predict future prices and you cannot time the market. The only solution for individual investors (or any investors) is to pick a risk level that you are comfortable with and then ride the ups and downs of the market. In the end you'll come out ahead.

HT: John.

Thursday, March 28, 2013

Defined benefit or defined contribution? There is a difference.

Unfortunately, my local paper -- the News and Observer, seems a little confused about the difference between a defined benefit plan and a defined contribution plan.

The relevant sentence in the article is:

Just to be clear:

A defined benefit retirement plan is a plan where the beneficiary is promised a specific financial benefit based on some formula of years served and contributions made into the plan. A pension plan is an example of a defined benefit plan.

A defined contribution plan is a plan where the beneficiary pays into the plan and gets a financial benefit that depends entirely on how well his/her contributions have grown in value. A 401k plan is an example of a defined contribution plan.

Thanks to Ron for the link.

The relevant sentence in the article is:

The discussion comes as state leaders consider a shift from a pension program to a defined-benefit system.This makes no sense. The current pension program is a defined benefit system.

Just to be clear:

A defined benefit retirement plan is a plan where the beneficiary is promised a specific financial benefit based on some formula of years served and contributions made into the plan. A pension plan is an example of a defined benefit plan.

A defined contribution plan is a plan where the beneficiary pays into the plan and gets a financial benefit that depends entirely on how well his/her contributions have grown in value. A 401k plan is an example of a defined contribution plan.

Thanks to Ron for the link.

Preventing bank runs in Cyprus

Cyprus is the latest Euro-zone country to be teetering on the brink of collapse. A key problem facing regulators there is the threat of a bank run. Briefly stated, a bank run can occur when the depositors of a bank all try and withdraw their funds at the same time. In most cases, they choose to do this because there are concerns about the solvency of the bank. However, the mere threat of a bank run can be enough to render a bank insolvent.

Which brings us back to Cyprus. The linked video shows some of the lengths that Cypriot regulators are going to to try to prevent a bank run.

Bank runs are rare - although we saw one a few years ago in the UK.

Which brings us back to Cyprus. The linked video shows some of the lengths that Cypriot regulators are going to to try to prevent a bank run.

Bank runs are rare - although we saw one a few years ago in the UK.

Monday, March 25, 2013

Want to increase firm value? Put an academic on the board

Interesting paper that finds that firms with academics on their boards are more profitable.

This research is part of a large literature that looks at the role of the Board of Directors in affecting firm value. In general this research finds that outside directors (those not affiliated with the firm) provide better governance than insiders. This paper goes one step further by showing that if those outside directors are B-School academics - the governance effect is even stronger.

Via: Marginal Revolution

This research is part of a large literature that looks at the role of the Board of Directors in affecting firm value. In general this research finds that outside directors (those not affiliated with the firm) provide better governance than insiders. This paper goes one step further by showing that if those outside directors are B-School academics - the governance effect is even stronger.

Via: Marginal Revolution

Saturday, March 23, 2013

Your portfolio needs fossil fuels - Green Alpha is wrong.

OK - before I get in to this post - I should say that in full disclosure, I am a member of the Sierra Club - I think it is a great organization and I support a lot of their work, but this article that appeared on the "Green Alpha" blog - housed on the Sierra Club website is, quite frankly, a load of ...

Ok - let me back up a bit. Green Alpha is a socially responsible fund management firm started by the Sierra Club to offer environmentally friendly investment options. Depending on which product you invest in, you can pay 1-2% management fees (ouch!).

Back to the article - the author claims that investing in fossil fuel companies is a bad idea - from an investment standpoint. Now I get that the Sierra Club thinks that reliance on fossil fuels is bad for the environment - but are they also bad for your wealth?

If Green Alpha claims that as a socially responsible fund, that they should not invest in fossil fuels - then that's fine, although I do note that they invest in Google, which, in 2011, used as much electricity as would be needed to power 200,000 homes. But that's a debate for another day.

No, the reason green alpha thinks we shouldn't buy energy stocks is because they argue that Modern Portfolio Theory advocates a portfolio that is better suited to the 1950s than today.

To argue that MPT is somehow flawed is really a feeble attempt to justify an investment strategy that only invests in a subset of assets and then charges very high fees for doing so.

By investing in a subset of stocks, you are going to increase your risk without getting a corresponding increase in return. In effect, you are giving up some diversification. This might make you feel better about yourself, but it won't help the Polar bears, and it certainly won't help your retirement portfolio. On top of that, you are likely to pay way too much in fees for this suboptimal portfolio.

My advice: If you care about the environment - index (and yes, hold energy stocks), but bike to work from time to time, turn down your thermostat a bit and even donate to the Sierra Club.

Ok - let me back up a bit. Green Alpha is a socially responsible fund management firm started by the Sierra Club to offer environmentally friendly investment options. Depending on which product you invest in, you can pay 1-2% management fees (ouch!).

Back to the article - the author claims that investing in fossil fuel companies is a bad idea - from an investment standpoint. Now I get that the Sierra Club thinks that reliance on fossil fuels is bad for the environment - but are they also bad for your wealth?

If Green Alpha claims that as a socially responsible fund, that they should not invest in fossil fuels - then that's fine, although I do note that they invest in Google, which, in 2011, used as much electricity as would be needed to power 200,000 homes. But that's a debate for another day.

No, the reason green alpha thinks we shouldn't buy energy stocks is because they argue that Modern Portfolio Theory advocates a portfolio that is better suited to the 1950s than today.

Modern portfolio theory’s asset allocation models were made for and reflect a world where fossil fuels were the only imaginable primary power source.This is utterly wrong. MPT's asset allocation models were not made for any specific world. Heck they'd work in a world where all power came from solar, wind or butterfly burps. Modern Portfolio Theory states that the efficient portfolio is based on balancing the volatility and expected returns of all available investable assets. The net result is that the weighting of each asset class in the "optimal portfolio" is that asset's market value. MPT says nothing about green energy, or fracking, or hybrid cars.

To argue that MPT is somehow flawed is really a feeble attempt to justify an investment strategy that only invests in a subset of assets and then charges very high fees for doing so.