The "big" news yesterday was that the Dow Jones Industrial Average closed at a record high. While this is an attention grabbing headline - it is actually pretty meaningless.

The Dow Jones Industrial Average is a price weighted index. In short the index is computed by adding up the prices of 30 big stocks and then dividing them by a number called the divisor. As a result, the index only measures changes in prices and is based on a very arbitrary computation.

A better way of measuring the performance of the Dow Jones stocks is the Dow Jones Industrial Total Return Index which includes dividends paid on the stocks.

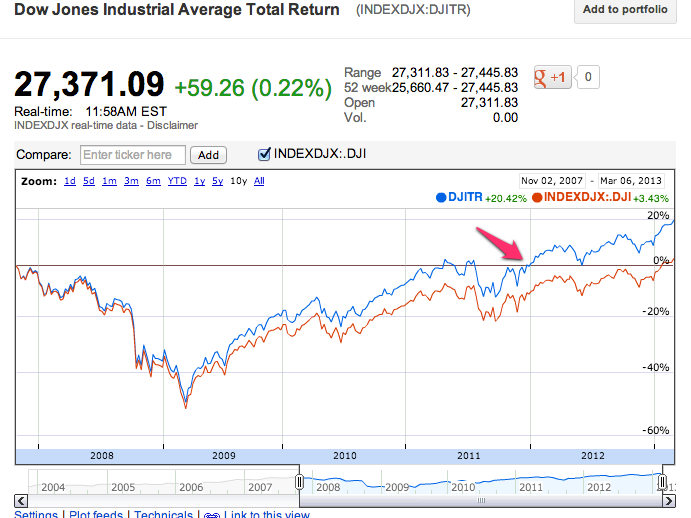

We can see the difference quite clearly:

The blue line is the total return index. I've shown them both from the last record level of the price index which was October 2007. What is clear is that the total return index beat its previous record around the end of 2011. To date it is up 20% since then.

This clearly shows the importance of dividends in computing a return and why just looking at a price index is really pretty pointless.

A Finance Professor's blog. I am a Professor of Finance in the Poole College of Management at NC State University. My website: https://sites.google.com/ncsu.edu/warr Opinions are my own.

Subscribe to:

Post Comments (Atom)

What's going on with inflation?

I recently posted an article on the Poole College Thought Leadership page titled: " What's going on with inflation?" . This w...

-

There are a lot of similarities between the boom and bust of the Beanie Baby market in the 1990s and booms and busts in financial markets. ...

-

Another inflation illusion post. This time with math. Again the issue here is that you can't just increase the discount rate when you a...

-

I recently posted an article on the Poole College Thought Leadership page titled: " What's going on with inflation?" . This w...

No comments:

Post a Comment