Wonderful post by Cliff Asness that shows in the short run the basic tenets of risk and return seem to get all jumbled up (bonds earning more than stocks, etc), but in the long run it all works out.

That's the point. In the long run it all works out. Trashing finance theories because they didn't work this week is stupid. As is basing asset allocation decisions on short term performance and market conditions.

Here's the conclusion it all of its finance theory supporting beauty.

A Finance Professor's blog. I am a Professor of Finance in the Poole College of Management at NC State University. My website: https://sites.google.com/ncsu.edu/warr Opinions are my own.

Friday, December 19, 2014

Wednesday, December 17, 2014

ESOP at a grocery store

Apparently the employees of the Winco grocery chain are doing very well in the retirement department, thanks to an ESOP (employee share ownership plan).

This Forbes article gushes about awesome this all is, but makes no mention of the elephant in the room. I'll give you a hint: Nobody at Enron ever thought that their retirement plans would become worthless overnight!!

So while the ESOP makes a lot of sense in some ways, in other ways, the employees are horribly un-diversified. They are one very bad salmonella outbreak away from loosing their jobs and their savings.

This Forbes article gushes about awesome this all is, but makes no mention of the elephant in the room. I'll give you a hint: Nobody at Enron ever thought that their retirement plans would become worthless overnight!!

So while the ESOP makes a lot of sense in some ways, in other ways, the employees are horribly un-diversified. They are one very bad salmonella outbreak away from loosing their jobs and their savings.

Wednesday, December 3, 2014

AQR puts data library online

AQR - the investment firm, has published the data sets used in its research papers. A great resource for those interested in testing out momentum and other strategies!

https://www.aqr.com/cliffs-perspective/introducing-the-aqr-data-library

https://www.aqr.com/cliffs-perspective/introducing-the-aqr-data-library

Tuesday, November 18, 2014

Do the portfolios of finance professionals underperform?

Apparently, using data from "the yelp of investing", it has been discovered that finance professionals underperform advertising and tech professionals when it comes to investing.

At first blush, this finding seems consistent with yet another failure for finance. But I think the truth is somewhat less exciting. I am guessing that finance professionals are far more diversified and more conservative in their investments. A point that is raised in the article.

Further on there is discussion of a research paper that finds that finance experts don't beat regular folks when it comes to mutual funds. Again, I don't think that there is much surprise here for the simple reason that markets are efficient. Being an expert in finance doesn't make you able to predict the future.

Ironically, being an expert in finance does tell you that you shouldn't pay big fees to experts in finance to run your money. You should index.

At first blush, this finding seems consistent with yet another failure for finance. But I think the truth is somewhat less exciting. I am guessing that finance professionals are far more diversified and more conservative in their investments. A point that is raised in the article.

Further on there is discussion of a research paper that finds that finance experts don't beat regular folks when it comes to mutual funds. Again, I don't think that there is much surprise here for the simple reason that markets are efficient. Being an expert in finance doesn't make you able to predict the future.

Ironically, being an expert in finance does tell you that you shouldn't pay big fees to experts in finance to run your money. You should index.

Thursday, November 13, 2014

Why the $13bn mortgage fraud settlement against Chase is pretty much a sham

The ugly truth revealed in Rolling Stone. It's a long article but worth the read.

All very depressing, especially in light of the most recent scandal involving forex market rigging by various UK banks.

Basically, despite the largest financial crisis since the great depression, nothing has changed and the regulators seem happy with that outcome.

All very depressing, especially in light of the most recent scandal involving forex market rigging by various UK banks.

Basically, despite the largest financial crisis since the great depression, nothing has changed and the regulators seem happy with that outcome.

Monday, November 10, 2014

The lottery - an embarrassment to our state.

John Oliver rips the lottery - and pays particularly attention to North Carolina.

Thursday, November 6, 2014

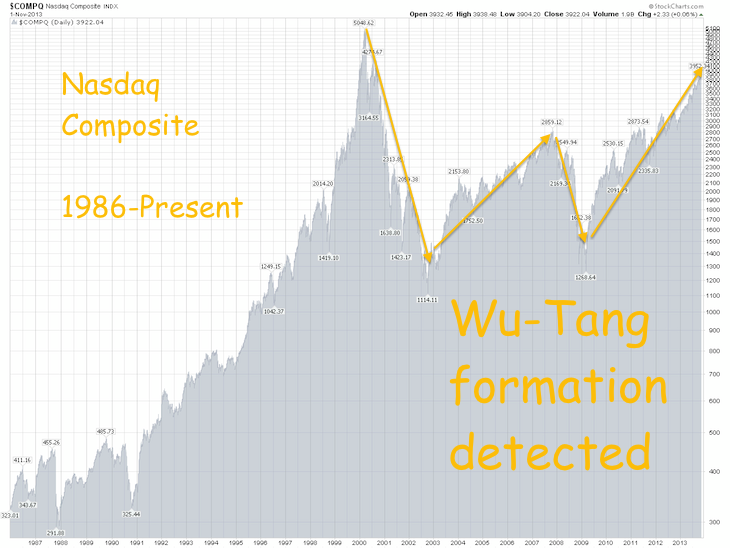

A 30 second course on asset allocation

From Josh Brown: http://thereformedbroker.com/2014/11/06/thirty-second-course-on-asset-allocation-2/

Josh cites Jeremy Siegel's classic "stocks for the long run" which argues, that over any 30 year period, stocks virtually always beat bonds. Still this doesn't mean that everyone should be 100% stocks - a topic that I've blogged on quite a bit over the years. You can see my old posts here:

http://financeclippings.blogspot.com/search?q=stocks+for+the+long+run

Josh cites Jeremy Siegel's classic "stocks for the long run" which argues, that over any 30 year period, stocks virtually always beat bonds. Still this doesn't mean that everyone should be 100% stocks - a topic that I've blogged on quite a bit over the years. You can see my old posts here:

http://financeclippings.blogspot.com/search?q=stocks+for+the+long+run

Tuesday, November 4, 2014

UK to start paying off perpetual bonds.

A 100 years ago, the British government decided to consolidate a variety of its debts. In effect the government took out debt consolidation loans. These loans got the name "Consols".

The debts consolidated read like a history of the UK including costs from Napoleonic wars and even the South Sea Bubble Crisis of 1720.

Now, the UK government has now announced that it will begin "calling" - or redeeming - some of these debts - in effect finally paying them off.

Consols are interesting not just because of the slice of history that they provide, but because they are also perpetual bonds. The pay a fixed coupon forever. They are valued using the simple formula:

A recent quote shows a 2.5% consol trading off a yield of about 3.86%. This would price the bond at:

The Economist has a nice article about the introduction of Consols. (Might be behind a paywall).

As a side, from this picture of one of the bonds that was consolidated. It is pretty clear why we call interest payments on debts "coupons"!

The debts consolidated read like a history of the UK including costs from Napoleonic wars and even the South Sea Bubble Crisis of 1720.

Now, the UK government has now announced that it will begin "calling" - or redeeming - some of these debts - in effect finally paying them off.

Consols are interesting not just because of the slice of history that they provide, but because they are also perpetual bonds. The pay a fixed coupon forever. They are valued using the simple formula:

A recent quote shows a 2.5% consol trading off a yield of about 3.86%. This would price the bond at:

The Economist has a nice article about the introduction of Consols. (Might be behind a paywall).

As a side, from this picture of one of the bonds that was consolidated. It is pretty clear why we call interest payments on debts "coupons"!

Perpetual securities are actually not as rare as we might think. Another similar type of security is Preferred Stock - which pays a fixed dividend forever. Berkshire Hathaway (Warren Buffet's firm) bought a big chunk of preferred stock from Bank of America a few years back.

Monday, October 27, 2014

A tepid defense of hedge funds by Cliff Asness

Cliff Asness of AQR capital has an excellent blog - well worth reading. A recent posting is called a tepid defense of hedge funds.

This is a nice article and from it we can draw a few interesting conclusions...

1. Hedge funds look a lot like boring stocks (they have betas between 0 and 1).

2. Based on 1), hedge funds are not hedged. If they were, they would have zero betas.

3. The positive alpha earned by hedge funds is probably not enough to cover the 2/20 fees that they charge.

4. Hedge funds didn't really provide much protection in 2008.

This is a nice article and from it we can draw a few interesting conclusions...

1. Hedge funds look a lot like boring stocks (they have betas between 0 and 1).

2. Based on 1), hedge funds are not hedged. If they were, they would have zero betas.

3. The positive alpha earned by hedge funds is probably not enough to cover the 2/20 fees that they charge.

4. Hedge funds didn't really provide much protection in 2008.

Tuesday, October 14, 2014

Is Yahoo worthless?

I missed this story earlier when Alibaba went public, but as we're talking about stock valuation, it is timely to talk about why Yahoo's US operations is basically worthless. Another article is here

The math is pretty simple (numbers as of 10/14/2014):

YHOO - $38/share - Market Value $38Bn.

BABA - $85/share - Market Value $209Bn.

YHOO owns 16% of BABA. So YHOO's share of BABA is 0.16*209Bn = $33.44Bn

YHOO also owns 35% of Yahoo Japan (YAHOY) Mkt Cap = $20Bn.

So YHOO's share of YAHOY is 0.35*20 = $7Bn.

So YHOO's non-BABA, non-Japan operations are worth: 38 - 33.44 - 7 = $-2.44Bn

What does this mean?

There are two ways of looking at this. One is to say that YHOO is worthless. This is perhaps a little surprising given that the company is profitable.

Another way of looking at this is to assume that BABA is overpriced and YHOO is underpriced. In which case a rational trader would try to short BABA and go long YHOO.

This latter option isn't as crazy as it may seem. In fact, it occurred famously with 3COM and Palm.

Saturday, October 11, 2014

Multitasking in class?

Most professors allow students to use laptops in class. Many students use them to take notes, to look at spreadsheets etc - but many students also use them for multi-tasking. And I use the term "multi-task" very broadly.

When I sit in other professor's classes to review teaching, I often am surprised by the amount of "multi-tasking" that is going on. I usually sit at the back where I can get a good view and invariably, students that are engaged in "multi-tasking" are on facebook, checking the weather, checking email etc. They aren't really multi-tasking, they are just doing a different task from what they are supposed to be doing.

That's why this article was particularly interesting to me. A Professor of New Media at NYU has basically banned laptops from class (except for specific projects). He's reporting a much improved environment.

A counter argument from a student might be:"Hey, if the prof says anything interesting or important, I'll pay attention", but I think this is perhaps a little delusional. I know that if I am at home watching a movie and in the quiet bit, I answer an email on my laptop, I invariably end up having to ask my wife: "what happened?" I am pretty sure that I can't multi-task effectively.

When I sit in other professor's classes to review teaching, I often am surprised by the amount of "multi-tasking" that is going on. I usually sit at the back where I can get a good view and invariably, students that are engaged in "multi-tasking" are on facebook, checking the weather, checking email etc. They aren't really multi-tasking, they are just doing a different task from what they are supposed to be doing.

That's why this article was particularly interesting to me. A Professor of New Media at NYU has basically banned laptops from class (except for specific projects). He's reporting a much improved environment.

A counter argument from a student might be:"Hey, if the prof says anything interesting or important, I'll pay attention", but I think this is perhaps a little delusional. I know that if I am at home watching a movie and in the quiet bit, I answer an email on my laptop, I invariably end up having to ask my wife: "what happened?" I am pretty sure that I can't multi-task effectively.

Your daily latte

Saw this article on Marketplace.org today about the cost of daily latte. Apparently, at some point in the past, the meme was that you're going to live in poverty at retirement because of your latte habit today.

I wanted to check the numbers, so if you assume 250 $5 coffees a year over 30 years, I reckon the future value is about $70,000 in today's dollars.

I assumed a 4% after inflation return, which is important, because I am basically assuming that in real terms, the cost of a coffee stays at about $5.

While $70K is not going to make a monumental difference at retirement, it isn't chump change!

I wanted to check the numbers, so if you assume 250 $5 coffees a year over 30 years, I reckon the future value is about $70,000 in today's dollars.

I assumed a 4% after inflation return, which is important, because I am basically assuming that in real terms, the cost of a coffee stays at about $5.

While $70K is not going to make a monumental difference at retirement, it isn't chump change!

Friday, October 10, 2014

Be wary of those who dismiss the EMH

Nice little article on the EMH - efficient markets hypothesis.

http://www.bloombergview.com/articles/2014-10-10/the-market-outsmarts-everyone

http://www.bloombergview.com/articles/2014-10-10/the-market-outsmarts-everyone

Opportunity costs at Olive Garden.

Olive Garden restaurants don't pay rent to the parent company, Darden. This raises the question as to whether the true opportunity cost of the real estate that the restaurants sit on is being fulling realized.

http://www.vox.com/2014/9/18/6343665/starboard-olive-garden

The situation has has come to a head now that an activist investor has replaced the entire Board of Darden restaurants in order to effect a change.

This is a great example of corporate governance and capital budgeting interacting.

Prediction: Fewer Olive Garden restaurants.

http://www.vox.com/2014/9/18/6343665/starboard-olive-garden

The situation has has come to a head now that an activist investor has replaced the entire Board of Darden restaurants in order to effect a change.

This is a great example of corporate governance and capital budgeting interacting.

Prediction: Fewer Olive Garden restaurants.

Wednesday, October 1, 2014

Bond Market Liquidity

We typically think of Treasuries as being very liquid - by which we mean that an investor can buy and sell a large quantity of the asset with little impact on the price. We're also implicitly assuming that there is no new information about the asset's fundamental value.

So look what happened recently for TIPS (Treasury Inflation Protected Securities) when Bill Gross, Chairman of PIMCO (one of the biggest fixed income management shops) quit.

Article here; http://www.bloomberg.com/news/2014-10-01/gross-exposes-42-trillion-bond-market-s-key-flaw-in-pimco-exit.html

If we look at the real rate of return on TIPS since they were first issued, we can see that the real return has declined over the years. This could be due to a secular decline in real rates, but is also, at least in part, consistent with some liquidity premium being present in the TIPS yield.

So look what happened recently for TIPS (Treasury Inflation Protected Securities) when Bill Gross, Chairman of PIMCO (one of the biggest fixed income management shops) quit.

The day Gross left Pimco to join Janus Capital Group Inc. (JNS), Mexican government bonds declined 0.3 percent, inflation-protected U.S. bonds lost 0.4 percent and debt of Verizon Communications Inc. (VZ) -- one of his bigger company holdings -- dropped 0.3 percent. That compares with a 0.05 percent decline on the Bank of America Merrill Lynch Global Broad Market Index.and

“Less liquid sectors such as TIPS continued to weaken as a result of Pimco concerns,” Leduc wrote in a Sept. 30 note. “There has not been measurable impact in most liquid sectors.”

Article here; http://www.bloomberg.com/news/2014-10-01/gross-exposes-42-trillion-bond-market-s-key-flaw-in-pimco-exit.html

If we look at the real rate of return on TIPS since they were first issued, we can see that the real return has declined over the years. This could be due to a secular decline in real rates, but is also, at least in part, consistent with some liquidity premium being present in the TIPS yield.

Wednesday, August 27, 2014

Fantastic investigative report into alternatives in the pension fund.

Investigative reporting at its best, done by Tom Bullock of WFAE 90.7 - public radio in Charlotte.

It's in two parts. Well worth listening to.

http://wfae.org/post/cowell-s-alternative-part-1-high-fees-secrecy-surround-pension-investments

http://wfae.org/post/cowell-s-alternative-part-2-conflicts-interest-claims-and-campaign-donations

It's in two parts. Well worth listening to.

http://wfae.org/post/cowell-s-alternative-part-1-high-fees-secrecy-surround-pension-investments

http://wfae.org/post/cowell-s-alternative-part-2-conflicts-interest-claims-and-campaign-donations

Tuesday, July 29, 2014

Dilbert on stock splits...yeah Apple, we're talking about you.

Via Josh Brown.

A not so veiled jab at the recent 7:1 stock split undertaken by Apple. Apparently having a high stock price is no longer cool.

How generous are the top 50 S&P 500 companies' 401K plans

There's a big difference across plans, and it has nothing to do with investment options. As usual, the details are in the fine print.

Monday, July 28, 2014

"Close the business schools!!" says English Professor.

An amusing rant from a humanities professor who seems to have an axe to grind with B-Schools and Finance Profs in particular. Whenever you read an article in which the market is referred to in quotes, as in: "the market", you know that what follows is going to be a complete failure to understand the basics of supply and demand.

Monday, July 21, 2014

Why would a non-profit issue taxable bonds?

To avoid regulation. Apparently, universities are increasingly issuing taxable bonds (where the bond buyer has to pay taxes on the interest) in order to get greater flexibility in where those funds can be used. In effect, the borrowers are paying more interest to avoid covenants imposed the federal government.

Thursday, July 17, 2014

Finance research summarized for non-academics

Check out this new online journal/magazine that reproduces summaries of top finance research targeted at a broader audience. This is an excellent idea and the first two issues contain some really good papers.

http://fame-jagazine.com/

It comes at a time when some people are questioning whether academic research in business is a positive NPV project.

http://fame-jagazine.com/

It comes at a time when some people are questioning whether academic research in business is a positive NPV project.

Friday, June 27, 2014

More on Dark Pools - fascinating stuff.

A 45 minute radio program from NPR. Well worth a listen if you want to understand why stock trading is now dominated by professional insiders who are able to game the operations of markets to exploit other traders.

However, when the other traders are large institutions, it isn't clear that anything wrong is going on here. These are big multi-billion dollar companies playing in a big market. What is clear is that individual investors should steer clear (and index)!

http://www.thereformedbroker.com/2014/06/27/talking-dark-pools-and-hft-on-npr/

However, when the other traders are large institutions, it isn't clear that anything wrong is going on here. These are big multi-billion dollar companies playing in a big market. What is clear is that individual investors should steer clear (and index)!

http://www.thereformedbroker.com/2014/06/27/talking-dark-pools-and-hft-on-npr/

Thursday, June 26, 2014

Picking Pockets in Dark Pools

Josh Brown has a fascinating bit on how Barclays allegedly set up a dark pool so that informed traders to make money of the institutions suckered into trading there.

http://www.thereformedbroker.com/2014/06/26/rolling-the-drunks/

At this stage these are just allegations, but still.

http://www.thereformedbroker.com/2014/06/26/rolling-the-drunks/

At this stage these are just allegations, but still.

Sunday, June 8, 2014

An Uber valuation

Uber, the "find a taxi" app, has been priced at around $18bn based on a recent funding deal. Now, while I have an awful track record for pricing the latest internet fad, $18 bn does seem a little steep for a company that will, perhaps, earn $200 million in a good year.

Using the flawed Price/Sales ratio as a valuation metric, Uber's valuation is about 90 times revenue. To put this in perspective, Facebook and LinkedIn are around 12 times.

It will be entertaining to see how this one plays out.

Using the flawed Price/Sales ratio as a valuation metric, Uber's valuation is about 90 times revenue. To put this in perspective, Facebook and LinkedIn are around 12 times.

It will be entertaining to see how this one plays out.

Thursday, June 5, 2014

More on the dark side of hedge funds.

Which begs the question, is there a light side?

http://www.theguardian.com/money/2014/jun/01/hedge-funds-power-wall-street-pulling-strings

http://www.theguardian.com/money/2014/jun/01/hedge-funds-power-wall-street-pulling-strings

ECB announces a negative interest rate

The ECB (European Central Bank) has set a negative interest rate. As Time Value of Money math is still correct, this means that a euro today is worth less than a euro tomorrow.

Thursday, May 22, 2014

NC State MBA a top overperformer

Yet more love from Poets and Quants on our MBA program.

http://stevenallenblog.blogspot.com/2014/05/nc-state-mba-top-overperformer.html

HT: Steve Allen's Blog.

http://stevenallenblog.blogspot.com/2014/05/nc-state-mba-top-overperformer.html

HT: Steve Allen's Blog.

Thursday, May 15, 2014

The folly of market timing the pension fund

Almost a year ago, the NC Treasurer was pushing a bill to expand alternatives in the pension fund. At the time, she, and the bill's sponsors argued that interest rates were likely to rise and the bond market would get crushed.

And in september, Janet Cowell stated stated that "The North Carolina pension fund has always been a big investor in bonds, and that has served us really well, but we're at the end of that runway," on WRAL TV

Sen. Hise, the bill's sponsor said: "I firmly believe the riskiest thing we could be (invested) in right now is the bond market" in the N&O

And in september, Janet Cowell stated stated that "The North Carolina pension fund has always been a big investor in bonds, and that has served us really well, but we're at the end of that runway," on WRAL TV

I'm not knocking Sen Hise, or Treasurer Cowell's ability to forecast interest rates - they had a 50/50 chance of being correct, and indeed, they may still end up being correct that rates will rise. Or they may not.

The point here is that basing asset allocation decisions on forecasts of interest rates is a poor way to manage $85 billion. Anyone who thinks that they can reliably forecast interest rates is either is misleading themselves, or the people that they are talking to. It just cannot be done. Interest rates will rise and fall, but a diversified portfolio of low cost investments, will, in the long run do OK.

HT:Ron for the heads up on interest rates.

Tuesday, March 18, 2014

Friday, March 14, 2014

Why did the market fall today?

Depends who you ask - but Josh Brown offers a range of explanations based on media outlet.

A snippet:

A snippet:

Wall Street Journal: Tensions in Ukraine and the Crimean peninsula

Yahoo Finance: Russians

Fox Business: Obamacare

CNBC: It didn’t sell off at all, it was actually a reverse rally

Forbes: Taxes are too high

Huffington Post: Taxes are too low

Fox News: Gay marriage

Motley Fool: Sign up here to find out!

Tuesday, March 11, 2014

Wednesday, March 5, 2014

"I don't consider the bloody ROI" ...

... said Apple CEO Tim Cook.

First I find it amusing that the word "bloody" - a great staple of the English language in its native country - is making its way into the mainstream lexicon in the USA. But for it to be really effective, I recommend combining it with "hell" from time to time.

But back to Mr. Cook. Mr Cook was being questioned on the Apple's CSR (corporate social responsibility) policies by a conservative "think tank" (the National Center for Public Policy Research). Mr Cook didn't appreciate the line of questioning - hence the money quote in the title of this blog post.

I think Aswath Damodaran frames the issue quite well. There is plenty of evidence that CSR policies can create shareholder value when conducted in a careful and thoughtful manner. But responding as he did, Mr Cook gave the NCPPR a great sound bite that ends up making Apple look bad. That said, the alternative reality that the NCPPR occupies is so devoid of any understanding of science that I can understand why Mr. Cook was so exasperated.

First I find it amusing that the word "bloody" - a great staple of the English language in its native country - is making its way into the mainstream lexicon in the USA. But for it to be really effective, I recommend combining it with "hell" from time to time.

But back to Mr. Cook. Mr Cook was being questioned on the Apple's CSR (corporate social responsibility) policies by a conservative "think tank" (the National Center for Public Policy Research). Mr Cook didn't appreciate the line of questioning - hence the money quote in the title of this blog post.

I think Aswath Damodaran frames the issue quite well. There is plenty of evidence that CSR policies can create shareholder value when conducted in a careful and thoughtful manner. But responding as he did, Mr Cook gave the NCPPR a great sound bite that ends up making Apple look bad. That said, the alternative reality that the NCPPR occupies is so devoid of any understanding of science that I can understand why Mr. Cook was so exasperated.

Tuesday, March 4, 2014

Charlotte Observer on NC Pension Fund Fees

Today, the Charlotte Observer tried to sort out the debate on the level of fees paid by the NC Pension Fund to hedge fund managers.

The debate has evolved into what fees do Fund of Fund managers pay the managers of the hedge funds that they hire? Ted Siedle, the consultant hired by SEANC argues that these fees are massive and greatly underreported by the pension fund. The pension fund (and Andy Silton) argue that Siedle's estimates are overblown.

I think we're missing the point here. So let me recap. Until a couple of years ago, nobody cared about the fees being paid by the Pension Fund. Then, during the Treasurer's reelection campaign, one of her opponents starting raising the issue. Since then a few vocal critics have continued to argue that the pension fund pays too much in fees and doesn't disclose the fees adequately. SEANC realized that this was an issue of importance to its members and hired Ted Siedle to look into the matter.

Here are the key issues:

1. The fees are too high.

The article quotes a spokesperson for the pension fund who says that the fees are only 0.52% in total. 0.52% may not seem much, but on $86 billion it is well over $400 million per year. As a contrast, my personal retirement portfolio with TIAA-CREF has an average fee of 0.1%. I find it hard to believe that I have better buying power than the State of North Carolina. My portfolio also outperforms the State's.

2. The fees being paid by the State are not unusual.

They are the industry standard fees. The problem is simply that the Pension Fund is allocating too much money to high fee investment products such as hedge fund funds of funds. This is a debate about poor asset allocation.

3. The Pension Fund does not adequately disclose all the fees paid.

We don't know whether Mr. Siedle's estimates are too high or too low, because these layers of fees are not disclosed. But my guess is that if they were disclosed - if we saw all of the trading costs and fees incurred by the pension fund - the total fee bill would be well over half a billion dollars.

Let me repeat that: a reasonable guess of total fees must be over $500 million.

This is what SEANC is upset about, and it is what all tax payers and citizens of NC should be upset about. The State Pension fund is handing over around half a billion dollars annually to Wall Street and in exchange is getting mediocre performance.

The debate has evolved into what fees do Fund of Fund managers pay the managers of the hedge funds that they hire? Ted Siedle, the consultant hired by SEANC argues that these fees are massive and greatly underreported by the pension fund. The pension fund (and Andy Silton) argue that Siedle's estimates are overblown.

I think we're missing the point here. So let me recap. Until a couple of years ago, nobody cared about the fees being paid by the Pension Fund. Then, during the Treasurer's reelection campaign, one of her opponents starting raising the issue. Since then a few vocal critics have continued to argue that the pension fund pays too much in fees and doesn't disclose the fees adequately. SEANC realized that this was an issue of importance to its members and hired Ted Siedle to look into the matter.

Here are the key issues:

1. The fees are too high.

The article quotes a spokesperson for the pension fund who says that the fees are only 0.52% in total. 0.52% may not seem much, but on $86 billion it is well over $400 million per year. As a contrast, my personal retirement portfolio with TIAA-CREF has an average fee of 0.1%. I find it hard to believe that I have better buying power than the State of North Carolina. My portfolio also outperforms the State's.

2. The fees being paid by the State are not unusual.

They are the industry standard fees. The problem is simply that the Pension Fund is allocating too much money to high fee investment products such as hedge fund funds of funds. This is a debate about poor asset allocation.

3. The Pension Fund does not adequately disclose all the fees paid.

We don't know whether Mr. Siedle's estimates are too high or too low, because these layers of fees are not disclosed. But my guess is that if they were disclosed - if we saw all of the trading costs and fees incurred by the pension fund - the total fee bill would be well over half a billion dollars.

Let me repeat that: a reasonable guess of total fees must be over $500 million.

This is what SEANC is upset about, and it is what all tax payers and citizens of NC should be upset about. The State Pension fund is handing over around half a billion dollars annually to Wall Street and in exchange is getting mediocre performance.

Monday, March 3, 2014

Poets and Quants on the NC State Jenkins MBA

A really great write up of our MBA program. If you are thinking of getting your MBA or know someone who is, you need to read this.

HT: My colleague Steve.

HT: My colleague Steve.

Saturday, March 1, 2014

How much does the NC Pension Fund pay hedge fund advisors?

The answer is hard to figure out. While the pension fund will disclose (reluctantly) the fees paid directly to managers - in many cases those managers hire other managers who in turn charge another layer of fees. This practice is common and indeed the norm in the hedge fund industry where investors contract with "fund of funds" managers.

So how much are these hidden fees? According to the Treasurer's office fees paid to Franklin Street Partners (an alternative investments manager) by the pension fund were around $2.6 million. But an ongoing SEANC audit reveals that when fees to the funds managed by Franklin Street partners are accounted for, this total fee bill is $16 million. And this is just one manager.

A more detailed discussion appeared on Forbes. And a brief summary of the problem was discussed on WRAL news.

Apparently Franklin Street states they aren't doing anything wrong and this is normal industry practice. I am sure they are correct. But that's the problem. Normal industry practice is all about making Hedge Fund managers rich.

So how much are these hidden fees? According to the Treasurer's office fees paid to Franklin Street Partners (an alternative investments manager) by the pension fund were around $2.6 million. But an ongoing SEANC audit reveals that when fees to the funds managed by Franklin Street partners are accounted for, this total fee bill is $16 million. And this is just one manager.

A more detailed discussion appeared on Forbes. And a brief summary of the problem was discussed on WRAL news.

Apparently Franklin Street states they aren't doing anything wrong and this is normal industry practice. I am sure they are correct. But that's the problem. Normal industry practice is all about making Hedge Fund managers rich.

Friday, February 28, 2014

Wednesday, February 26, 2014

Goldman Sachs Elevator Gossip

Hitting the news today is the "revelation" of the person behind the @GSElevator twitter feed. The twitter feed is an insight into the minds of some of the Wolves of Wall Street. Some quotes confirm all that you suspect is wrong about Wall Street, other quotes are brilliant.

A recent sampling;

A recent sampling;

#1: I just want to be rich enough to not be motivated by money.

— GS Elevator Gossip (@GSElevator) December 14, 2013

#1: Don't apologize for being late with a Starbucks latte in your hand.

— GS Elevator Gossip (@GSElevator) December 19, 2013

33% of DJIA is 5 stocks. Gauging the economy on that is like putting the back of your hand on your forehead for a health exam.

— GS Elevator Gossip (@GSElevator) December 2, 2013

#1: Some chick asked me what I would do with 10 million bucks. I told her I'd wonder where the rest of my money went.

— GS Elevator Gossip (@GSElevator) November 12, 2013

And finally..

#1: I don't have an iPhone case. I'm not irresponsible or poor.

— GS Elevator Gossip (@GSElevator) November 9, 2013

Tuesday, February 25, 2014

Rebalancing my portfolio

You'd think a that finance professor would be monitoring his portfolio daily... however this prof usually has better things to do. That said, I have to admit that I've been neglecting my portfolio. But tonight I did a thorough bit of house keeping. I also learned a few things along the way.

Like most academics my retirement money is with TIAA-CREF, although the basic ideas are the same regardless of provider.

I have two primary goals - first to get all expenses ratios to be under 10 bp or 0.1%, and second to rebalance to 80% equities, 20% bonds. The first goal is no brainer. The second goal will either seem horribly aggressive or way too conservative depending on your perspective.

Here's what I found.

1. Some fees are surprisingly high

I discovered that I had quite a few funds in my account that had expense ratios of 0.40-0.50%. But there are options in the plan that have expense ratios of less than 0.1%. What was I thinking!!! It might seem small, but cutting 0.3% from my expense ratios is a non-trivial amount. I won't share the details, but let's just say that it would pay for dining out every week of the year.

2. The choices are not the same across plans

I have four plans. Two from my prior employer and two from my current employer. For both employers there is an optional plan and the main plan. The optional plans have much more choice. For example they contain bond index funds and international index funds. The main plans have limited choices.

3. I needed to rebalance

I only had 3% in bonds - because I haven't rebalanced in years. Therefore I rebalanced my current portfolio as follows:

S&P 500 Index TISPX 50%

Bond Index TIBFX 20%

International Index TCIEX 16%

Small Cap Index TISBX 14%

Because of the differing choices across the plans, these rebalancings can't be done evenly. For example, one plan was rebalanced entirely into bonds because it was a plan that offered the low cost bond index fund.

4. I needed to change future allocations

I set up my future contributions as follows:

S&P 500 Index TISPX 50%

Bond Index TIBFX 15%

International Index TCIEX 15%

Small Cap Index TISBX 20%

Like most academics my retirement money is with TIAA-CREF, although the basic ideas are the same regardless of provider.

I have two primary goals - first to get all expenses ratios to be under 10 bp or 0.1%, and second to rebalance to 80% equities, 20% bonds. The first goal is no brainer. The second goal will either seem horribly aggressive or way too conservative depending on your perspective.

Here's what I found.

1. Some fees are surprisingly high

I discovered that I had quite a few funds in my account that had expense ratios of 0.40-0.50%. But there are options in the plan that have expense ratios of less than 0.1%. What was I thinking!!! It might seem small, but cutting 0.3% from my expense ratios is a non-trivial amount. I won't share the details, but let's just say that it would pay for dining out every week of the year.

2. The choices are not the same across plans

I have four plans. Two from my prior employer and two from my current employer. For both employers there is an optional plan and the main plan. The optional plans have much more choice. For example they contain bond index funds and international index funds. The main plans have limited choices.

3. I needed to rebalance

I only had 3% in bonds - because I haven't rebalanced in years. Therefore I rebalanced my current portfolio as follows:

S&P 500 Index TISPX 50%

Bond Index TIBFX 20%

International Index TCIEX 16%

Small Cap Index TISBX 14%

Because of the differing choices across the plans, these rebalancings can't be done evenly. For example, one plan was rebalanced entirely into bonds because it was a plan that offered the low cost bond index fund.

4. I needed to change future allocations

I set up my future contributions as follows:

S&P 500 Index TISPX 50%

Bond Index TIBFX 15%

International Index TCIEX 15%

Small Cap Index TISBX 20%

This isn't ideal - I'd like more in international, but the main plan from my employer doesn't offer the international index fund. So I have to use the 403(b) - which is a smaller contribution.

Conclusion.

Grab a beer, glass of wine or your choice of beverage, sit down with a spreadsheet and take time to do a thorough inventory of your retirement portfolio. Don't get hung up on choosing funds, instead focus on low cost funds that will deliver your desired stock/bond mix.

Note: despite my goal of getting all fees below 0.1%, I note that TIBFX has an expense ratio of 0.3%.

Monday, February 24, 2014

Friday, February 21, 2014

Thursday, February 20, 2014

Facebook's purchase of Whatsapp...

A couple of divergent opinions on the latest shopping spree from Facebook.

Felix Salmon:

Zuckerberg will dominate the mobile market at any cost because he has almost bottomless pockets.

Kid Dynamite:

This looks like an April Fool's day deal. FB has paid through the nose for people who by definition use Whatsapp because it is basically free. It's Groupon all over.

Me:

I've given up trying to figure out whether what FB does makes any sense. I note that as of today, the price of FB is trading close to $70. My earlier prognostications about the stock being overvalued at IPO were wrong. This is why I index - I am a useless stock picker, but to my credit, I know this.

Felix Salmon:

Zuckerberg will dominate the mobile market at any cost because he has almost bottomless pockets.

Kid Dynamite:

This looks like an April Fool's day deal. FB has paid through the nose for people who by definition use Whatsapp because it is basically free. It's Groupon all over.

Me:

I've given up trying to figure out whether what FB does makes any sense. I note that as of today, the price of FB is trading close to $70. My earlier prognostications about the stock being overvalued at IPO were wrong. This is why I index - I am a useless stock picker, but to my credit, I know this.

Wednesday, February 19, 2014

Another way of looking at Twitter's lack of profit

David Lowery of Camper Van Beethoven on twitter's profits (or lack thereof)

Monday, February 17, 2014

Employee stock options as explained by an English major.

http://thebillfold.com/2014/02/employee-stock-options-as-explained-by-an-english-major/

Key quote: Always join a company before the lawyers do.

Key quote: Always join a company before the lawyers do.

Tuesday, February 11, 2014

Rental Home Securitization

Rental homes are the latest in the long list of financial assets that are been securitized. On one hand, having capital moving into the real estate market should help to reduce the backlog of foreclosed homes. But on the other hand it is hard to ignore our past experience of securitization. The spectre of house prices being bid up to a point that creates another bubble looms large.

Another concern, as indicated by the graphic in the article, is the high density of ownership by a single investor (in this case - Blackstone)

It seems as though Blackstone is trying to control the market in rental properties in some locales. There really can only be one reason for this - and that is to have sufficient market power to control the rental level in an urban region.

Another concern, as indicated by the graphic in the article, is the high density of ownership by a single investor (in this case - Blackstone)

Planet Money vs MacroEcon Lectures

From the Counterparties Twitter Feed.

Study says: Planet Money podcast better at teaching students macro than "boring lectures" http://t.co/OeASey7cjq

— Counterparties (@counterparties) February 11, 2014

Monday, February 10, 2014

Hedge Fund TV

Brace yourselves - Hedge Fund TV is coming.

I won't be letting my kids watch - I don't want to pollute their minds.

I won't be letting my kids watch - I don't want to pollute their minds.

Apple's $14bn share buyback

An article asks whether Apple's huge buyback could be better used - perhaps in developing new products.

The motivations for a buyback are complex (and responding to Karl Icahn's pressure may be one), but in terms of a simple IRR analysis, a buyback generates a return of about 3% + 0.8*5% = 7% for shareholders. This is the expected return on AAPL stock (using the the CAPM).

While I am sure Apple has plenty of interesting research and development projects, it might be the case that returning money to shareholders so that they can invest it, rather than keeping it money market securities provides the best return. Shareholders are then free to reinvest this money in other firms which might be seeking dollars to finance their R&D programs.

CAPM assumptions:

RF = 3%

Market Risk Premium = 5%

AAPL Beta = 0.8

The motivations for a buyback are complex (and responding to Karl Icahn's pressure may be one), but in terms of a simple IRR analysis, a buyback generates a return of about 3% + 0.8*5% = 7% for shareholders. This is the expected return on AAPL stock (using the the CAPM).

While I am sure Apple has plenty of interesting research and development projects, it might be the case that returning money to shareholders so that they can invest it, rather than keeping it money market securities provides the best return. Shareholders are then free to reinvest this money in other firms which might be seeking dollars to finance their R&D programs.

CAPM assumptions:

RF = 3%

Market Risk Premium = 5%

AAPL Beta = 0.8

Friday, February 7, 2014

Meat tax?

I've written before about pigovian taxes (i.e. carbon taxes). These are taxes lobbied to reduce consumption of some item. In the case of carbon taxes, they are designed to reduce fossil fuel consumptions. Such a reduction would presumably have environmental benefits. The key to such taxes is that they must be revenue neutral. In other words, all revenue from them should be channeled back in the form of rebates or tax reductions elsewhere. A good example would be a reduction in payroll taxes.

But here's a new take on the idea of pigovian taxes. A meat tax. The logic is simple - animals produce a lot of methane, and methane gas is a green house gas. Therefore a policy that reduces methane emissions would be good for the environment.

Personally I am all for it. But then again, I don't eat meat.

But here's a new take on the idea of pigovian taxes. A meat tax. The logic is simple - animals produce a lot of methane, and methane gas is a green house gas. Therefore a policy that reduces methane emissions would be good for the environment.

Personally I am all for it. But then again, I don't eat meat.

Thursday, February 6, 2014

Buffet vs Hedge Funds.

In a 10 year, $1 million bet against a hedge fund manager, Warren Buffet put his money on an S&P 500 index fund. We're now in year 6. Guess who's ahead?

HT: Rob.

HT: Rob.

Tuesday, February 4, 2014

What determines research productivity in university departments?

A recent paper attempts to tackle this question and finds that the total citation count of the incoming department chair's research publications is a strong predictor of future departmental research output.

In other words, if you want to up your department's research, appoint high powered researcher as the chair.

In other words, if you want to up your department's research, appoint high powered researcher as the chair.

Monday, February 3, 2014

Bob Dylan and American Cars.

I had to chuckle at Bob Dylan's nauseating super bowl commercial about Chrysler which gushed with American pride. Clearly Bob ignores the fact that Chrysler is wholly owned by Fiat, and that of the top 10 American made cars, only one is a Chrysler product.

Hey BlueNC, there's a difference between underfunding and underperformance!

Recently, I was mentioned on BlueNC (a progressive website) in their Tuesday Twitter round up

I quote:

But university professors should know better than relying on safe tactics to back up their positions. North Carolina's pension plan weathered the storm admirably:

Perhaps I can explain to the folks at BlueNC the difference between underperformance and underfunding.

Underfunding happens when the state doesn't put enough money into the pension plan, or the plan lags its return assumption over a long period of time.

Underperformance can occur at anytime and is when the pension fund earns a return that is less than a reasonable benchmark.

The NC pension fund was slightly underfunded in 2008, but performed poorly in 2008. Notably, the alternatives in the portfolio did terribly that year. As the recent push into alternatives is supposed to mitigate downside risk, the 2008 data point is of great interest. It shows clearly that alternatives don't deliver downside protection.

So BlueNC - there is a difference between underperformance and underfunding and this university professor knows exactly what he is talking about, unlike some other folks.

I quote:

But university professors should know better than relying on safe tactics to back up their positions. North Carolina's pension plan weathered the storm admirably:

Year/Value of assets/Accrued liability/Unfunded liability/Funded ratio2006 $68,808,403,000 $65,862,247,000 $(2,946,156,000) 104.47%

2007 $72,952,274,000 $70,573,970,000 $(2,378,304,000) 103.37%

2008 $73,124,299,000 $73,627,879,000 $503,580,000 99.32%

2009 $74,447,112,000 $76,976,542,000 $2,845,127,000 96.71%

2010 $76,599,104,000 $79,558,260,000 $2,959,156,000 96.28

Perhaps I can explain to the folks at BlueNC the difference between underperformance and underfunding.

Underfunding happens when the state doesn't put enough money into the pension plan, or the plan lags its return assumption over a long period of time.

Underperformance can occur at anytime and is when the pension fund earns a return that is less than a reasonable benchmark.

The NC pension fund was slightly underfunded in 2008, but performed poorly in 2008. Notably, the alternatives in the portfolio did terribly that year. As the recent push into alternatives is supposed to mitigate downside risk, the 2008 data point is of great interest. It shows clearly that alternatives don't deliver downside protection.

So BlueNC - there is a difference between underperformance and underfunding and this university professor knows exactly what he is talking about, unlike some other folks.

Professors charged with illegal shorting.

Two professors (from Florida State) are caught by the SEC for illegal naked shorting. While they don't admit guilt, they did agree to pay a hefty fine.

Shorting isn't illegal, but naked shorting can be. Naked shorting occurs when you sell a stock that you don't own and then fail to deliver the stock to the person you sold it to.

HT:Rob.

Shorting isn't illegal, but naked shorting can be. Naked shorting occurs when you sell a stock that you don't own and then fail to deliver the stock to the person you sold it to.

HT:Rob.

Sunday, February 2, 2014

Further thoughts on politics in the state pension fund.

Today, the N&O ran a letter from Ron Elmer that sharply criticizes Andy Silton's recent column about politics in the state pension fund. I wrote about that here.

The N&O printed Elmer's letter and Silton's response. Because neither are on the N&O website, I've linked to Silton's blog where he posted them.

Elmer's letter makes two simple points.

1. The pension fund is underfunded. The amount it is underfunded is subject to debate, but it ranges from a little to a lot. The reason for the variation is simply because in order to estimate how well funded a pension plan is, you must make assumptions. The disagreements are all due to the assumptions.

That said, most people who understand the issue, and that includes Mr. Silton and Ms. Cowell, would probably concede that there is an underfunding problem. This problem faces all states, thankfully, NC is in better shape than most.

2. The pension fund is underperforming. Here is where it gets tricky. Elmer argues that this is in part because of allocations to alternatives. Silton, on the other hand says that the underperformance isn't actually underperformance per se - but a result of a more conservative strategy overall. More conservative portfolios will have lower expected returns than more risky portfolios.

Here's my take:

1. Yes, the fund is underfunded. This should be addressed immediately, but dealing with item 2, will help.

2. Assuming that Silton is correct, and that this is an asset allocation issue, then I would argue that the asset allocation is wrong. The pension fund is too conservative. But this is overly simplistic. A better allocation would be one that has limited exposure to alternatives and instead focuses on more traditional investments while minimizing fees. When the fees on the fund are running close to $400 million per year, reducing fees will have a big impact on helping that underperformance.

I commend both Ron Elmer and Andy Silton for engaging in an open, public discussion of this very important issue, although Silton's comment that Elmer looks like he's running for state treasurer again was a bit of a cheap shot. Resorting to an ad hominem attack is a common strategy when you don't have facts to support your argument.

The N&O printed Elmer's letter and Silton's response. Because neither are on the N&O website, I've linked to Silton's blog where he posted them.

Elmer's letter makes two simple points.

1. The pension fund is underfunded. The amount it is underfunded is subject to debate, but it ranges from a little to a lot. The reason for the variation is simply because in order to estimate how well funded a pension plan is, you must make assumptions. The disagreements are all due to the assumptions.

That said, most people who understand the issue, and that includes Mr. Silton and Ms. Cowell, would probably concede that there is an underfunding problem. This problem faces all states, thankfully, NC is in better shape than most.

2. The pension fund is underperforming. Here is where it gets tricky. Elmer argues that this is in part because of allocations to alternatives. Silton, on the other hand says that the underperformance isn't actually underperformance per se - but a result of a more conservative strategy overall. More conservative portfolios will have lower expected returns than more risky portfolios.

Here's my take:

1. Yes, the fund is underfunded. This should be addressed immediately, but dealing with item 2, will help.

2. Assuming that Silton is correct, and that this is an asset allocation issue, then I would argue that the asset allocation is wrong. The pension fund is too conservative. But this is overly simplistic. A better allocation would be one that has limited exposure to alternatives and instead focuses on more traditional investments while minimizing fees. When the fees on the fund are running close to $400 million per year, reducing fees will have a big impact on helping that underperformance.

I commend both Ron Elmer and Andy Silton for engaging in an open, public discussion of this very important issue, although Silton's comment that Elmer looks like he's running for state treasurer again was a bit of a cheap shot. Resorting to an ad hominem attack is a common strategy when you don't have facts to support your argument.

Sunday, January 26, 2014

SEANC's concern about the State Pension Fund is not politically motivated

Andy Silton's Sunday column in the News and Observer (here) claims that attacks on the State Pension Fund are politically motivated. This couldn't be farther from the truth.

SEANC (the state employees association) recently retained Ted Siedle of Benchmark Alert Inc, a pension consulting firm, to engage in a detailed investigation of the practices of the state pension. Mr. Siedle is a frequent contributor to Forbes and is well known for exposing misdeeds and problems at state run funds.

In Mr. Silton's mind, SEANC is engaged in some sort of misguided witch hunt. He states in his column:

Let's be clear here. The reason SEANC retained Mr. Sielde's firm is because the Treasurer's office has failed, over the years, to clearly disclose the fees and compensation arrangements that it has with the numerous Wall Street managers that run the state's money. If the Pension Fund was being run in a transparent manner, SEANC's actions would be entirely unnecessary.

To imply that this is all somehow political, is just silly. SEANC is non-partisan, and it's hard to see why an organization that represents state employees would be going after the Treasurer who is a Democrat for purely political reasons. In the current political environment, Democrats in senior positions are few and far between.

The reason why SEANC is consistently applying pressure to the State Treasurer's office is because the fund is being poorly managed. It is that simple. The pension fund is moving more heavily in to high fee alternative investments. These investments have weak performance records and will hurt the stability of the fund in the long run. Mr. Silton sort of acknowledges this but states:

The key issue here is that the Treasurer and her staff may have studied this in depth, but they have reached the wrong conclusion. There is a mountain of academic research that will confirm this. This academic research is very clear. So let me summarize it:

In the long run, high fee investments will underperform low fee investments.

It is that simple.

If the pension fund wants to reduce risk, then there are low fee ways to do this, but investing in alternative investments will not achieve that goal. The pension fund's poor performance in 2008 is anecdotal evidence of this fact.

Finally, I'd note that in my discussions with the SEANC folks, they understand the difference between a well funded plan and a well managed plan. North Carolina's plan is relatively well funded compared to a lot of states (relatively is the key word here). But it is not well managed. A recent Op-Ed by Ardis Watkins of SEANC nicely explains this distinction.

A poorly managed pension fund is something that all citizens of NC should care about. But the good news is that fixing the problems is pretty easy.

All SEANC is trying to do is move the fund in the right direction for the benefit of everyone.

SEANC (the state employees association) recently retained Ted Siedle of Benchmark Alert Inc, a pension consulting firm, to engage in a detailed investigation of the practices of the state pension. Mr. Siedle is a frequent contributor to Forbes and is well known for exposing misdeeds and problems at state run funds.

In Mr. Silton's mind, SEANC is engaged in some sort of misguided witch hunt. He states in his column:

What I don’t understand is the vehement attack spearheaded by SEANC. SEANC charges that the pension has performed poorly and is being hobbled by excessively high fees. Moreover, SEANC has retained a consultant to probe the pension plan for potential improprieties.He goes on to say..

However, there’s no reason to launch investigations, use inflammatory language, or bury the investment staff in public records requests.

Let's be clear here. The reason SEANC retained Mr. Sielde's firm is because the Treasurer's office has failed, over the years, to clearly disclose the fees and compensation arrangements that it has with the numerous Wall Street managers that run the state's money. If the Pension Fund was being run in a transparent manner, SEANC's actions would be entirely unnecessary.

To imply that this is all somehow political, is just silly. SEANC is non-partisan, and it's hard to see why an organization that represents state employees would be going after the Treasurer who is a Democrat for purely political reasons. In the current political environment, Democrats in senior positions are few and far between.

The reason why SEANC is consistently applying pressure to the State Treasurer's office is because the fund is being poorly managed. It is that simple. The pension fund is moving more heavily in to high fee alternative investments. These investments have weak performance records and will hurt the stability of the fund in the long run. Mr. Silton sort of acknowledges this but states:

While I disagree with the decision to move so dramatically into alternatives, I have to respect the decision by Cowell and other fiduciaries to head in this direction. Why? Because after more than 30 years of investing, I know I could be wrong. Investments are a matter of judgment, and there is little doubt that our treasurer and her staff have studied this issue in-depth. We will, in due course, find out who is right. Frankly, I hope she is right and I am wrong, because it will be a difficult and slow process to reverse the commitment to alternatives.

The key issue here is that the Treasurer and her staff may have studied this in depth, but they have reached the wrong conclusion. There is a mountain of academic research that will confirm this. This academic research is very clear. So let me summarize it:

In the long run, high fee investments will underperform low fee investments.

It is that simple.

If the pension fund wants to reduce risk, then there are low fee ways to do this, but investing in alternative investments will not achieve that goal. The pension fund's poor performance in 2008 is anecdotal evidence of this fact.

Finally, I'd note that in my discussions with the SEANC folks, they understand the difference between a well funded plan and a well managed plan. North Carolina's plan is relatively well funded compared to a lot of states (relatively is the key word here). But it is not well managed. A recent Op-Ed by Ardis Watkins of SEANC nicely explains this distinction.

A poorly managed pension fund is something that all citizens of NC should care about. But the good news is that fixing the problems is pretty easy.

All SEANC is trying to do is move the fund in the right direction for the benefit of everyone.

Monday, January 13, 2014

Corporate guff awards

This year's awards for the worst types of corporate-speak:

http://www.bbc.co.uk/news/business-25652101

Good stuff.

http://www.bbc.co.uk/news/business-25652101

Good stuff.

Thursday, January 9, 2014

NC State Jenkins Online MBA program is number 36 nationwide.

Our online MBA program just graduated its first class and we're already ranked at number 36!

I have been involved in the development of the online program from its inception and this ranking reflects our goal of creating an exceptionally high quality online experience. I may be biased (I teach in the program) but I have to say that this is a very good MBA. And yes - you can apply...here

I have been involved in the development of the online program from its inception and this ranking reflects our goal of creating an exceptionally high quality online experience. I may be biased (I teach in the program) but I have to say that this is a very good MBA. And yes - you can apply...here

Subscribe to:

Comments (Atom)

What's going on with inflation?

I recently posted an article on the Poole College Thought Leadership page titled: " What's going on with inflation?" . This w...

-

There are a lot of similarities between the boom and bust of the Beanie Baby market in the 1990s and booms and busts in financial markets. ...

-

Another inflation illusion post. This time with math. Again the issue here is that you can't just increase the discount rate when you a...

-

I recently posted an article on the Poole College Thought Leadership page titled: " What's going on with inflation?" . This w...

.gif)