A Finance Professor's blog. I am a Professor of Finance in the Poole College of Management at NC State University. My website: https://sites.google.com/ncsu.edu/warr Opinions are my own.

Tuesday, December 15, 2009

Finally - what those mutual funds titles really mean

Excellent stuff - and quite funny unless you actually own one these things.

HT: Felix Salmon

Monday, December 14, 2009

Are stocks more risky in the long term

I'd guess that most investors think that stocks are actually safer in the long run than in the short run. This idea is supported by the well known book by Jeremy Siegel.

The intuition is based on a of time-based diversification - in the long run the ups and downs cancel themselves out.

But as Fama and French note, this logic suffers a fatal flaw. This time diversification effect only really works if you know what the true expected return is, and for stocks this is unknown. So, as the time horizon gets longer, you face risk from the volatility of the expected return, and also risk from not knowing what the expected return is.

Is Siegel's book wrong? The answer depends on how you view it. If you read it as a description of how well stocks did over the past 100 years, then it is a great read. If you think it tells us something concrete about the future, then I'd exercise more caution.

Sunday, December 13, 2009

RIP Paul Samuelson

Tuesday, December 1, 2009

Can you have positive alpha in an efficient market?

I don't think so. There is nothing in the efficient market theory that says that an investor cannot earn positive alpha. In fact it is entirely possible for an investor to beat the market for many years in a row. Market efficiency just says that the reason for the investor's success was luck, not skill.

Luck vs Skill in mutual fund management

Felix Salmon summarizes the article nicely here.

Still, most investors will ignore the results of this and other similar studies and chase returns by trying to pick actively managed funds. In the long run they will fail.

Tuesday, November 17, 2009

FF on duration, term structure and immunization

Thursday, November 12, 2009

Call options and insider trading

So knowing all this, if you knew that HP was about to launch a takeover of 3COM, what would you do? Answer: buy calls on 3COM of course.* Turns out that's what a lot of people did.

*assuming you were willing to risk breaking the law.

Monday, November 9, 2009

Fama and French on portfolio optimization and the equity premium.

Moral hazard and health care

The new health care plan that is making its way through the house prevents insurers from denying coverage based on a pre-existing condition. This is a great idea, but with it comes a moral hazard problem. Healthy people have the incentive to not get insurance until they get sick. Then they are guaranteed that they will be accepted into a plan. This doesn't just include the currently uninsured either. I have health insurance, but maybe I should drop my coverage and wait until I get really sick before reinstating it? I could save a huge amount. The economist, Martin Feldstein talks about the problem here.

The writers of the bill thought of this problem. Well sort of. They decided to impose a tax penalty on anyone who didn't get insurance. Brilliant! Except that the penalty is significantly less than the actual cost of insurance, so the problem does not go away.

I don't really want to get political here, but it seems to me that the problem with politicians is that they didn't take enough (or any) economics in school. In fact, if they had just read the book "Freakonomics" they would have seen an example of a very similar situation. I don't recall the exact details, but the basic story recounted in the book was that a day care center had a problem with parents being late to pick up their kids. To try to discourage this behavior, the day care center imposed a fine for each 30 minutes that the parents were late. The problem was that the fine was too low - well below the actual cost of child care. So instead of discouraging the behavior, more parents chose to be late and just pay the fine.

The solution to the health care moral hazard is simple. Make the penalty as much as the cost of insurance and force the non-insurers into a plan.

HT: Greg Mankiw's blog

Thursday, November 5, 2009

More on bank capital ratios

Which brings us to the question of banks being too big to fail. Here's another blog arguing that we need capital ratios that increase with size. Very large banks that become too big to fail should hold very large amounts of capital.

For more discussion, see my recent post about about how implicit and explicit government guarantees encourage excessive leverage.

Wednesday, November 4, 2009

Bank capital structure

But banks are different - because large banks are too big to fail, the presence of bankruptcy costs don't matter. Furthermore, as banks benefit from very low debt costs (due to deposit insurance), their optimal capital structure is frequently very high.

In reality, large banks are more risky because of the risk they transfer to outsiders (tax payers) and therefore they should hold more capital than equivalent banks of a smaller size. But of course the banks don't want to hold more equity capital as equity is expensive relative to deposits.

The article is well worth a read.

Another bubble coming?

Is market efficiency the culprit?

Monday, November 2, 2009

Home buyer's credits

May I suggest a better use for the money. If you want to stimulate the economy and increase employment, use the credit instead to reduce payroll taxes. You'll distribute the stimulus money evenly across the economy instead of just to a) new home buyers or b) people who want to trade their clunker for a prius.

Its always harder to dig out of the hole

The math is simple. Start with $100. Loose 50%. You've now got $50. To get back to $100 you need a 100% return.

Of course, you can get back quicker if you save more.

Wednesday, October 28, 2009

Inflation and stock prices.

The basic error of inflation illusion is that a nominal discount rate is used to present value a firm's cash flows while a real growth rate is used to grow them. The result is that when inflation increases, the discount rate goes up and the present value of cash flows declines. This leads to the oft-cited conclusion that stock prices will decline when inflation increases.

In fact, stocks are natural hedges against inflation because the cash flows are real. This means that they increase with inflation. As prices go up, the firm's revenue and cash flows increase accordingly.

At the simplest level, consider the Dividend Discount Model.

P = D1/r-g

D1 is the dividend expected next year. r is the nominal discount rate and g is the growth rate. An increase in inflation will increase r through the risk free rate. g will also increase at the rate of inflation. Because the numerator is r-g, the effect of inflation will cancel out.

Mr Winkler is not alone in suffering from inflation illusion. The effect has been well documented. The original idea of inflation illusion affecting stock prices was proposed by Franco Modigliani and Richard Cohn in 1979. Since then, numerous academics have studied the issue and found evidence of inflation illusion. For example, John Campbell and Tuomo Vuolteenaho find evidence in their American Economic Review paper in 2004. Yours truly also found evidence for inflation illusion in my 2002 Journal of Financial and Quantitative Analysis with Jay Ritter.

Inflation illusion also affects house prices, but that's a topic for another day...

Friday, October 23, 2009

Air freight and stock prices...

Here's an interesting example. On Monday Apple reported its quarterly earnings and let slip that it is paying for abnormally high air freight that is not iphone related.

Hmmm, what could this be for?

Of course, analysts are speculating that the company is prepping for the imminent release of a tablet computer.

This is a perfect example of new information that was not expected by the market, but that would have a material effect on the stock price.

Monday, October 19, 2009

Google's bandwidth bill is probably not zero.

The article argues that Google has soooo much fiber optic cable that it basically trades bandwidth with other ISPs and never pays for bandwidth. So if you're doing a cash flow analysis on youtube would assume that band width cost was really zero?

For a bonus, use the words "opportunity cost" and "sunk cost" correctly in your answer.

What about China and the US Government debt?

This article discusses the issue nicely.

I also need to drink beer with less serious people.

HT: Greg Mankiw

Smart guys on wall street...

A. Too many smart guys on wall street.

Or so says this entertaining article...

HT: My friend Robert

Thursday, October 15, 2009

A candid interview with a banker

Monday, October 12, 2009

Trouble with stock options, part deux

Well now there appears to be a new, but related scandal brewing. The WSJ discusses a new study by Fich, Cai and Tran at Drexel U. who find that firms that are in merger negotiations are pretty liberal with their option grants.

They allege that when negotiations about a merger are being quietly made, the target firm grants options to the CEO of the target. Then, when the merger is announced the stock price will most likely go up and the CEO makes out.

One possible explanation is that you want to incent the CEO to get the best possible price from the merger, and options will do that. But as is pointed out in the article, the CEO's pay package should already provide the correct incentives if it is well constructed.

.

High Frequency Trading and the small investor

One of the problems of HFT is that the little guy can get mowed down by the massive trades put on by HFT algorithms. Matthew Goldstein of Reuters discusses one such case.

As my undergrad students should know, a stop loss order is really just a market order to sell that is waiting to be triggered. The key risks with a stop loss is that it will either get triggered by a gyration in the stock or that it will trigger far below the original order price because the stock is moving so fast. This is precisely what happened in the case discussed by Goldstein, who says...

The lightening fast selling triggered a so-called stop-loss standing order Watson had with his broker to sell Dendreon shares if the stock fell into the low $20s. But the stock fell so fast that the broker didn’t actually sell Watson’s 1,500 shares until the price had hit $15

What to take away? If you are an individual investor trading stocks on your own, you are swimming with the sharks. Nothing good will come of it. You should be indexing.

HT: Felix Salmon

Saturday, October 10, 2009

How risky are stocks?

It states:

Look at the long-term average annual rate of return on stocks since 1926, when good data begin. From the market peak in 2007 to its trough this March, that long-term annual return fell only a smidgen, from 10.4% to 9.3%. But if you had $1 million in U.S. stocks on Sept. 30, 2007, you had only $498,300 left by March 1, 2009. If losing more than 50% of your money in a year-and-a-half isn't risk, what is?

Executive Pay

His article today makes a simple and often overlooked point. You have to include the value of past stock and option grants when figuring out how execs are compensated. You cannot just focus on this year's salary.

Many executives lost massive amounts of personal wealth when their company stock prices collapsed. No one feels bad for them as this is true pay for performance. Shareholders lost money and so did they.

Overall Yermack concludes that CEO compensation contracts work pretty well and the current witch hunt, which might be good for the media and some political careers, really won't make things better.

Thursday, October 8, 2009

Nobel Prize for Economics

Here's the list

Wednesday, October 7, 2009

Do TIPs provide inflation protection...?

Jeff Opdyke of The Wall Street Journal asks - "do these bonds provide inflation protection?" Its a good question, however I think that Opdyke's analysis has some problems.

First he points to the fact that the CPI is an imperfect measure of inflation. This is absolutely true, for example the CPI doesn't include extra bag fees for airlines. But I disagree that a flaw in the index is that it doesn't include borrowing costs. The CPI specifically doesn't include borrowing costs, in part because using a cost that is directly related to inflation in the index would lead to a feedback loop. Furthermore, when mortgage rates increase, the higher borrowing costs are offset by house price appreciation - so it is unclear whether a household's costs have truly increased.

A second point raised is that if you sell the bonds before they mature, you are not guaranteed the promised return. As my students should know, this is incorrect. To earn the initial yield to maturity you need to hold bonds whose duration is equal to your holding period. Holding the bonds to their maturity exposes you to reinvestment risk from the coupons. Zvi Bodie has talked about this issue and advocates target date duration matched TIPs funds for retirement.

Finally, Opdyke argues that 3% tips would underperform 5% tips in an environment where rates increase. We have to be careful here. If the rate increase is just due to higher inflation, then there will be no difference in the real return on these bonds. But if the increase reflects a higher real rate of interest, then the lower coupon bonds will be hurt more because they have a higher duration.

Overall though, this is an interesting article and well worth a read.

Tuesday, September 29, 2009

Friday, September 25, 2009

Google's option repricing.

At the time, Google argued that it was only fair to reset the strike price of the options because so many of them were so far out of the money due to the stock market collapse. Google wasn't alone. On March 23 Bloomberg reports that a range of companies were doing this.

When Google reset the options, the price of the stock was at $308, today the price is at $494. In effect Google orchestrated a massive wealth transfer from shareholders to employees. We're not talking chump change here either. The WSJ estimates the transfer was around $1.5 billion.

Their argument that they wanted to retain the best just doesn't fly. Would you quit your job with Google in the middle of the worst recession in 80 years?

As the Wall Street Journal points out, "Google is a different kind of company" - yes - one that gleefully fleeces its own shareholders.

Thursday, September 24, 2009

Finance Films

The comments on the post make for interesting reading and perhaps might contain a few suggestions for your netflix queue.

My personal faves are

Boiler room

Wall Street

Barbarians at the Gate

Rogue trader

Feel free to post any that I might have missed (as comments).

Wednesday, September 23, 2009

Sensationalist Wall Street Journal

Financial Times Alphaville

The blog is updated from London, New York and Tokyo and is designed to be a 24 hour news service. Its free - and also provides links to other blogs as well as the FT. I'll be adding it to my blog reader.

Monday, September 21, 2009

Front running a merger

Saturday, September 19, 2009

Tariffs on tires are a bad idea.

Pick 3 lottery stupidity

Exhibit A: The triangle troubleshooter (a column in the Raleigh News and Observer) reports the terrible wrong done to a poor woman who purchased 2 "Pick Three" tickets and, shock, horror, got the same number on both tickets. Oh the humanity...

The classic line from the lottery player is

"I don't have faith in this system," she said. "It doesn't make sense to me mathematically. There should be enough numbers that each ticket would be individual."

Consider the facts - its a pick THREE. There are 1000 possible numbers (assuming you allow 000), and 581,468 tickets are sold.

I propose that all proceeds from the lottery be directed to teach the citizens of this great state the basics of probability theory.

But until that happens, don't play the lottery unless a) you are severely mathematically challenged or b) you don't feel like you pay enough state tax.

Wednesday, September 16, 2009

What do economists think?

Mankiw also mentions the recent tire tariffs imposed by President Obama on Chinese tires. Most economists think tariffs are a very bad idea (me included). It does make you wonder though why new Presidents are so quick to levy tariffs. For example, GWB did a similar thing in 2002.

The price is right and the EMH

The conclusion is slightly amusing.

But that still leaves the first part of EMH intact; that you can't beat the market unless you have insider information. It implies that most of us are better off stowing our savings in a cheap fund that tracks the stock market, rather than with some expensive smarty-pants fund manager. There you go, an idea from economics that might save you money: who'd have thought it?

Tuesday, September 15, 2009

How did economists get it wrong?

HT: My friend Bill.

Did Lehman's collapse start the crisis?

In effect, these speeches [about TARP] amounted to "The financial system is about to collapse. We can't tell you why. We need $700 billion. We can't tell you what we're going to do with it." That's a pretty good way to start a financial crisis.

HT: Greg Mankiw

Friday, September 11, 2009

Healthcare in the UK

This short documentary (again on Frontline) talks about the UK system. This is clearly not the solution for the US, but I think it indicates that there are, perhaps, alternatives that work pretty well. As always, its all about getting the incentives right.

Breaking the bank...

You can watch it online, and I strongly recommend it to all my students. My only disagreement with the documentary was in the closing minutes where it is stated that basically the whole mess was Wall Street's fault, and now the Feds are running the show. I fundamentally disagree with this take. I, like many (or most) other economists put a large amount of the blame for the mess not on the lack of government regulation, but on the very poor and misguided regulation that encouraged subprime lending and allowed firms to abdicate their responsibility for risk management.

Anyhow, check out the show, its compelling viewing.

Thursday, September 10, 2009

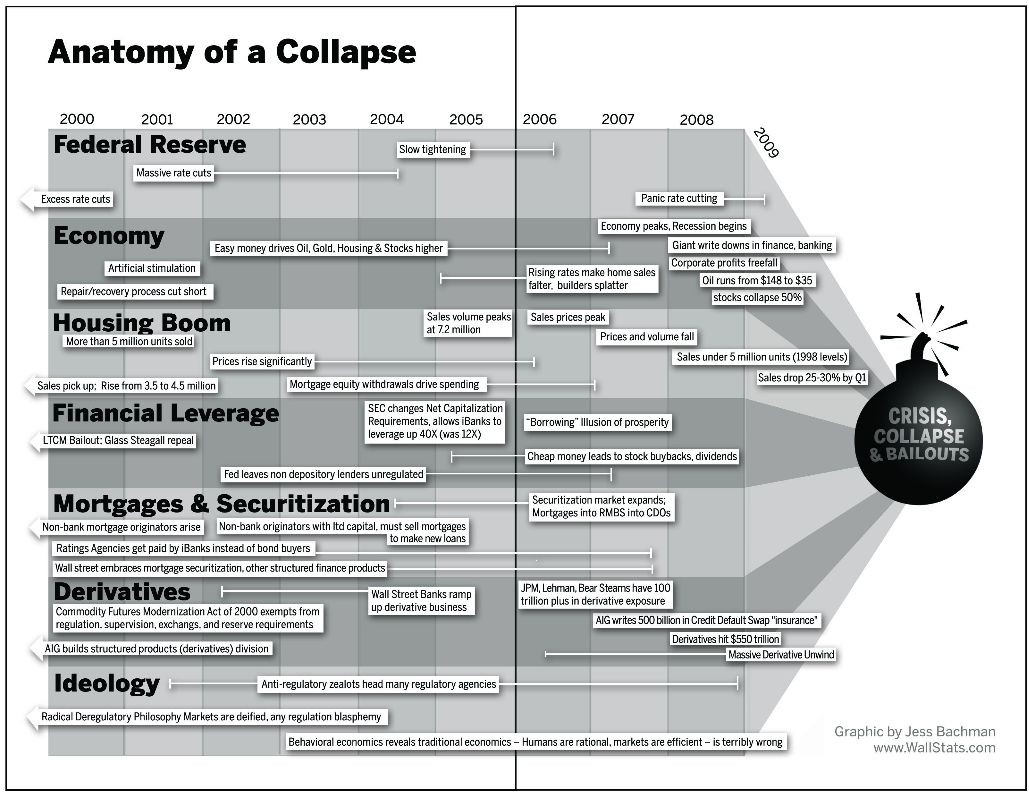

Follow the events that lead to the financial crisis

Wednesday, September 9, 2009

Alan Greenspan - it will happen again...

The cost of the financial meltdown

Powerpoint

Tuesday, September 8, 2009

The new auto industry breakdown

Friday, September 4, 2009

Linux and high frequency trading.

Its all a bit geeky, but if you're so inclined, read on. Apparently RedHat Linux powers the world's fastest stock exchange.

Incidentally, I use ubuntu linux.

The problems with alpha...

The source of the video is "falkenblog", and a more detailed post on the topic is here.

The quote:

One should remember that Enron was the subject of Harvard Business School case studies in 'best practices' management, they emphasized their 'risk management' and received plaudits there.

made me laugh out loud.

CNBC - it makes my head hurt

My favorite quote "I don't understand how that relates to what Larry was saying" - right because you are STUPID.

Actually for pure comedy value, CNBC is excellent.

Thursday, August 27, 2009

Finance Fallacy #1

Finance Fallacy #2

His basic idea, which is not new, he's been harping on it for a long time, is that stocks will on average beat bonds, but only on average. This means that the average investor will do OK investing in stocks for their retirement. But some investors will do a lot better than average and some will be do terribly (and end up eating dog food in their old age, as Zvi elegantly states). As an individual investor has only one shot at getting it right, being right on average is not too helpful.

Definitely worth listening to.

Incidentally, this is finance fallacy number 2, I'll have to look up what #1 is.

Hedge Fund Letters

Socially useless banks?

All this sounds like a slippery slope to me. What is "excessive" and does he really think that banks are "socially useless"? He also talks about "simplistic regulation". I don't think it was lack of regulation that lead to the particularly bad financial mess in the UK, just bad regulation. In particular, the government took the implicit role of lender of last resort to banks that are too big to fail. Instead, the government should regulate capital standards that are a function of the bank size.

Elsewhere in the article Turner questions whether the financial sector has grown too large. In a free market, capital will move to the the most productive use. In the UK, this turns out to be the financial sector, in part because there isn't much in the way of a significant manufacturing sector anymore. The only way that I could conceive that the financial sector was "too large" is if it is receiving some sort of government subsidy, such as an implicit guarantee. In which case, we know who to blame.

Tuesday, August 25, 2009

Liar's Poker

Bonds for the long run?

Unfortunately, many people misunderstood the basic idea. They assumed that stocks HAD to beat bonds over 30 year periods. This is absolutely not the case, all Siegel is saying is that they have, historically done so.

Incidentally, I highly recommend his book.

Which brings me to an excellent post on the Fama French Forum in which someone asks whether bonds will continue to beat stocks....read here.

FF's answer is really insightful. The key point here is to understand the difference between an expected risk premium and a realized risk premium.

As an analogy, confusing a realized risk premium and an expected risk premium is like thinking that it is a good time to buy beach property after a 100 year hurricane (as long as you sell within 100 years)!

Meir Statman on Behavioral Finance

Saturday, August 22, 2009

Thursday, August 20, 2009

Perfect markets

A recent article in the New Scientist (a UK publication) really illustrates how people - even very smart scientists just don't get economics.

In the article "Falling out of love with market myths", Terence Kealey (vice chancellor at the University of Buckingham, UK) attacks the economics concept of a perfect market.

I'd like to take a moment to explain why he is completely wrong.

In financial economics, we frequently talk and think about things in terms of perfect markets. Usually a perfect market is one with full information to all participants and no frictions (such as trading costs or taxes).

Mr Kealey argues that perfect markets are "bizarre" and that the theory, and the efficient market theory are "false".

Unfortunately, Mr Kealey just doesn't understand what the purpose is of a perfect market. In finance, we don't think for a minute that markets are perfect. They are not, there are taxes, trading costs, regulation, information asymmetries etc. But by starting with an idea of what a perfect market would look like, we are able to more fully understand the distortions that market imperfections are likely to play. Perfect markets are used as the foundation of more complex theories that attempt to explain how the world really is, and more importantly, how it will change if we change the imperfections in the market.

Students might note that in introductory MBA finance, we start with perfect markets when considering capital structure and also asset pricing.

Notwithstanding this fairly poor article, the New Scientist is an excellent publication.

Tuesday, August 4, 2009

A break down of the equity risk premium

I am inclined to agree that it is less than 6%, but I think it is probably incorrect to say it is zero.

I have a few issues with some of his arguments:

1.He claims that various studies have shown that the risk premium is declining, particularly since the 2000 market crash. The problem here is that I think he is confusing survey evidence of peoples expectations of the market risk premium with the implied premium that actually generates current prices. Before the market crash, in the late 90s, most investors thought stocks were great, would give high returns, and therefore would expect a high return over bonds. But of course, stocks were very expensive then and the implied premium was very low. After the crash the opposite occurs. Investors think stocks are awful, and expect low returns, but as prices are low, the implied premium is high.

2. He argues that transaction costs are ignored. But the evidence for bid-ask spread induced costs that he quotes are largely from pre-decimilization, when spreads were much higher than they are now. I agree that frequent trading will eat returns, but I don't see how this is really relevant to the equity premium. Nor do I see how poor market timing will impact the equity premium. Both of these factors will impact realized returns, but the equity premium is a fairly refined concept of the return you will earn as a buy and hold investor holding the market portfolio. In essence, someone how has an index fund in his/her 401k.

3. He states that the geometric mean will be much lower than the arithmetic mean due to volatility. No argument here, but this is a straw man as no reasonable person uses the arithmetic mean to estimate historic returns.

4. Peso problem. I completely agree that the US is a special case in that it has posted one of the highest historic premiums of any country. There is no reason to believe that the US should not mean revert to the average of the developed world.

So what is the correct premium? I sort of skirted around this issue here. But I think it is somewhere between say 2-6%. But don't quote me on that.

Finally, what would a zero percent premium mean? Well I doubt it will be along the lines of the Dow trading to 36000..

Wednesday, July 22, 2009

S&P at your finger tips

HT: FinanceProfessor.

Tuesday, July 21, 2009

Inflation illusion at the movies

Of course, these numbers are like apples and oranges. The CPI in 1984 was 105.3 today it is 215.693. To convert BHC to todays numbers we multiply 234 by 215.693 and divide by 105.3. This gives us a whopping $479.32 Million for Beverly Hills Cop in today's dollars.

You can get the CPI hot off the press from the Bureau of Labor Stats here.

Clearly, the Hangover has a way to go before it trounces Eddie Murphy.

However, I have to say that the Hangover was pretty much the funniest movie I have seen in a long long time.

The question remains hwoever, why don't journalists pay attention to inflation?

Textbook Economics

HT: Newmark's door

Monday, July 20, 2009

Robert Shiller on sub primes...

Felix Salmon disagrees and thinks this is a bad idea. But I think Felix is off the mark here. His criticisms of Shiller's argument are all based on sub prime borrowers getting loans that they couldn't repay. A transparent sub prime market where lenders bear risk would reduce the chance of this happening.

Monday, July 13, 2009

The end of asset allocation?

I don't really buy this whole, "the correlations have gone to 1" argument. First of all Felix states that correlation is impossible to measure and cites a wired article about the Gaussian Copula. This is a bit of a straw man. Correlation isn't hard to estimate at all. Felix's second point is that correlation is backward looking and therefore no good. I agree that it is a backward looking measure, but I wouldn't through the baby out with the bath water quite yet.

You have to consider what are the alternatives there are to asset allocation. Felix states:

In investing, nothing lasts forever. And the era of asset allocation is in its waning years. The problem, of course, is that no one has a clue what might replace it.

Asset allocation is not a trading or market timing strategy which might loose its ability to generate returns over time. Asset allocation is a method of managing risk. It will reduce portfolio risk overall, but as we have seen, in severe events, correlations do not necessarily go to 1, instead the impact of the market component on diverse assets becomes far more important. Nothing except being in cash would have saved you in the recent market drop, but for most time periods, asset allocation has and will continue to reduce portfolio risk. Put another way, if you are driving a car a seat belt (asset allocation) will help a lot, most of the time. But there are times when it won't (i.e. you drive off a cliff). That still doesn't mean that you shouldn't wear a seat belt.

Damodaran's blog

FinanceProf posts a video of one of Damodaran's lectures with the great tag line "dividends are like getting married, buybacks are like hooking up".

stocks for the long run?

Turns out, some of the data for the first 100 years or so was perhaps a little shaky.

Friday, July 10, 2009

I have a new fave blog

Finding this stuff interesting is a sign that you are a true finance geek! For example, the most recent post explains how you can extract inflation expectations from swaps. Brilliant stuff!

Thursday, July 9, 2009

How to deal with foreclosures

Wednesday, July 8, 2009

Did Diversification Fail When We Needed It Most?

Ken argues that the observation that correlations across asset classes went up recently is "probably a mis-perception". He argues that really what is happening is that the market component of risk became more significant, and to the extent that all assets have a market component, they will all be affected by this component.

However, at the end of the day, for an individual investor this is probably semantics. Pretty much everything went down!

Tuesday, July 7, 2009

Pope calls for new economic system

"Without doubt, one of the greatest risks for business is that they are almost exclusively answerable to their investors, thereby limited in their social value."

I think the Pope is a little off the mark here. There is actually tremendous social value in an enterprise whose goal is to maximize shareholder wealth. First, millions of us rely on these firms to create wealth for our retirement. Second, maximizing shareholder wealth often results in greater resources being available for charitable work - take the Bill and Melinda Gates foundation for example. Third, the free market system in which capital flows to the most productive use is responsible for the improvement of the lives of millions - through medical advances, technology etc.

I don't think that this is the first time the Pope has been off the mark, but this is a finance blog so we won't go there.

Monday, July 6, 2009

Evil market jargon?

Jack doesn't think that we should use such words as they are hard to understand. He suggests instead the following....

Legally, I can’t recommend that you use it to punish those who use the four self-important terms below. That said, if you hear someone use one of the terms, and if you happen to be standing behind them, and if you love America and you’re not holding a dangerously hot coffee at the time (or if it at least has a lid), I think we both know what needs to be done

Jack goes on to say about beta..

In one common but flawed approach, a stock’s risk is defined by its past trading volatility.

Uh, I don't think that's right actually. But I hate to throw the "covariance" word in to the mix given the tone of the article.

Excellent stuff. Mr Hough's columns are brilliant comic relief.

How maths killed Lehman

The online magazine "Plus - living mathematics" has a few other nice articles related to finance...

What does a financial engineer do?

How to price derivatives

and is Maths to blame?

Rolling Stone: Blame Goldman Sachs

Felix Salmon, also reviewed the article and found much to agree with.

Finally, Felix gets a response from GS.

I have to say though that Mr Salmon's stock went down a bit with me after he referred to vegans as "bonkers".

Anyhow, good stuff if you've got some spare time to read it all.

Is the worst over?

Federal debt and the level of interest rates

Thursday, July 2, 2009

Behavioral economics / finance

It is important to distinguish between the behavior of people reacting to incentives, which might seem irrational, and true behavioral factors. In the book "Freakonomics" there is a section on a day care center which tried to deal with tardy parents picking up their kids by imposing a fine on late pickups. The result - more late pickups, because the fine was less than the hourly cost of daycare, and parents rationally responded to the offer of this "after hours" care. This is not really an example behavioral economics.

An example of behavioral finance is the 1/n rule. If you give people "n" choices - say 4 mutual funds in their retirement plan, folks will tend to put 25% of their money in each fund, when optimally a different allocation is probably best.

Anyhow, Scientific American has a piece on how bubbles develop.

The article first talks about "money illusion" a topic close to my heart as this was the focus of my PhD dissertation and subsequent publication in the Journal of Financial and Quantitative Analysis. Money illusion occurs when individuals fail to appreciate the effects of inflation on asset values. To quote from the article:

Robert J. Shiller, a professor of economics at Yale University, contends that the faulty logic of money illusion contributed to the housing bubble: “Since people are likely to remember the price they paid for their house from many years ago but remember few other prices from then, they have the mistaken impression that home prices have gone up more than other prices, giving a mistakenly exaggerated impression of the investment potential of houses.”

The article goes on to cover several other well documented examples of behavioral irrationality. Overall an excellent read.

Bond data online

HT: Felix Salmon

Tuesday, June 30, 2009

The value of a college degree - an example of bad math

The article also shows up here on the smartmoney website.

In finance lingo, he is saying that a college degree is a negative net present value project. At first blush it looks like he has a point. The first page of the article gives the example of two individuals. One starts work and the other goes to college and assumes a college loan. Mr Hough goes on to show that at retirement, the college grad will have about 1/3 of the wealth in his retirement account as his non-college going buddy.

Mr Hough then goes into a rather unfocussed rant explaining the reason for this - that basically professors are useless and we don't teach anything of value....

I smelled a rat.

Unfortunately the math in the example is completely wrong. The example assumes that both put aside 5% of their income to either retirement or paying down loans.

At age 22 the non-college guy will have a net pay of 16055 (assuming income growth and his 5% retirement payment).

The college guy on the other hand has a net pay of 22,329 after he has paid 5% of his salary to his loan (Mr Hough's assumption).

The example completely ignores the difference in their net pay, i.e. $22,329 - $16,055 = $6,274. It is implicitly assumed that college guy just spends this. But if he lived on the same net pay as the non-college guy, you can show that he'd pay of his loan in 3 years and retire with $3.4M (about 2.5 times as much as the non-college guy).

Now, in fairness to Mr Hough, he does note that:

I'm comparing only savings, not living standards.

Bill will presumably be able to afford nicer things than Ernie along the way.

But this is precisely the point! You have to look at total earnings, not just some arbitrary percentage of earnings. The difference in the two living standards is likely to be massive.

In my analysis, I assumed that this would all be invested by the college grad, but we could just assume that he'd invest enough to retire at an equal level with his non-college pal, and then enjoy the rest during his life.

I'm tempted to take a look at some ofMr Hough's other pontifications , but I need to do some real work. Maybe another day :)

In the meantime, Mr Hough really should brush up on his basic time value of money. That way maybe he won't give out as much bad advice.

Monday, June 29, 2009

Cap and Trade

The transitional gains problem represents yet another compelling argument for a carbon tax.

Thursday, June 25, 2009

Six Sigma

a process must produce no more than 3.4 defects per million opportunities

So, the fact that the knob on my GE tumble dryer dropped off after about a year is a 1 in 294,117 chance event. That's good to know.

From here on, this blog is going to be a six sigma blog with a no more than 1 typo every 300,000 words writtun.

The Jack Welch MBA

for example, on exec pay..

One extremely popular class would be “Maximising Your CEO Pay”. This columnist once heard Mr Welch tell a chief executives’ boot-camp that the key was to have the compensation committee chaired by someone older and richer than you, who would not be threatened by the idea of your getting rich too. Under no circumstances, he said (the very thought clearly evoking feelings of disgust), should the committee be chaired by “anyone from the public sector or a professor”

and the accounting class should be awesome...

Equally unmissable would be the class on “Making Your Numbers”. Under Mr Welch, GE’s accounting was so creative it could be hung on the wall of the Museum of Modern Art (although it was all within legal bounds). Frequent use was made of off-balance-sheet vehicles, on a greater scale even than Enron. The firm’s huge, opaque financial arm, GE Capital, was used as a top-up fund in case profits in the rest of the business fell below the consistent growth promised by Mr Welch. Over the 80 or so quarters he was in charge, GE’s profits grew so consistently they were almost a straight line. Those were the days.

Jack's partner in this enterprise is a guy by the name of Mike Clifford who, to quote the Wall Street Journal...

previously worked in broadcasting and telecommunications, and with evangelical Christian leaders such as Pat Robertson, Jerry Falwell and Bill Bright.

Sounds like a winner to me.

Tuesday, June 23, 2009

Harvard cutting risk

Tenure in academia

The truth is that tenure has served as an instrument of conformity since tenure votes are often glorified popularity contests. The fact that university professors donated to President Obama's campaign over John McCain's by a margin of eight to one is only the tip of the iceberg. Those professors who want tenure and disagree with the prevailing trends in their field -- or the political fashions outside of it -- know that they must keep their mouths shut for at least the first seven years of their careers.

I continue to be amazed by the unsubstantiated garbage that the WSJ will print on its Op Ed page. I have been involved in tenure decisions at my institution and they are not at all "glorified popularity contests" - they involve a very careful and rigorous scrutiny of the research record and potential for future research of the scholar in question.

There are many reasons why the US has the best higher education system in the world. I'd venture that tenure might be one of them, despite the musings of Ms. Riley, the Wall Street Journal's "taste" editor.

Triple A Punt - Credit Rating Agencies

I'm inclined to agree that a lot of the problems that we have faced in the past year or so have been due to a reliance on the three ratings agencies, who occupy a position of government mandated supremacy. Pension funds, endowments and other regulated investment entities like being able to delegate credit screening to these credit agencies - they don't have to do the credit screening themselves.

Now it turns out that S&P is planning to use the CDS market to help set their ratings. In effect they are going to take a clean market signal and repackage it as a noisy, infrequently updated credit rating.

As the CDS market providesan instantaneous market assessment of risk, the role for credit rating companies should be limited - except for the fact that they have a government mandate.

Monday, June 22, 2009

Where are cars made?

For example, the Toyota Sienna is assembled in Indiana using a US made engine and a US made transmission, whereas the Ford Mustang is assembled in Michigan with a V6 engine from Germany and a transmission from France or Mexico.

Friday, June 19, 2009

Thursday, June 18, 2009

The future of MBA education

Personally, I subscribe to the opinion of the Richard Cosier who is the Dean of the Krannert School at Purdue who is quoted as saying:

Saying schools should not teach complex financial models is erroneous, he says. “That’s like saying you can’t teach chemistry because you can make things explode . . . People make their own decisions.”

Saab - a negative NPV project.

In class we have talked a lot about NPV as a decision rule for evaluating projects and the recent news of GM's sale of Saab made me wonder what GM's original 2000 NPV analysis of Saab looked like (assuming that there was one). I'm guessing that there wasn't one. But I bet that if there was, they used GM's cost of capital and not a far higher one that a risky division like Saab would merit. Rick Wagoner stated in 2000 that ''The brand attracts a very different consumer than we normally see in General Motors showrooms ..... We want to keep that brand very distinctive and very unique.'' Sounds risky to me.

But by 2002 things looked pretty grim. Indeed, GM admitted that Saab never made money and Rick Wagoner said of Saab "you have to play the cards you're dealt". Wow, what a lame excuse when considering that GM picked the cards it was dealt.

Unfortunately, the US tax payer is now playing those cards.

Examples of hyperinflation

These are really just for interest only, as I don't believe that we are heading the way of Zimbabwe, despite the prognostications some "experts". See my recent post.

Tuesday, June 9, 2009

Words of wisdom from Ken French

More Sellers than Buyers?

and

Is This a Good Time for Active Investing?

Monday, June 8, 2009

Best online tools for personal finance

This American Life podcast on ratings agencies

Saturday, June 6, 2009

A difficult time

I personally know the unknown professor and he and his family are in our thoughts at this very difficult and very sad time.

Friday, June 5, 2009

Why active investing is a negative sum game

The intuition is simple. Passive investors hold a market cap weighted portfolio. Active investors don't. They over or under weight certain stocks. The gains to one active investor must then be offset by losses from another active investor. But both pay higher expenses. Therefore, in aggregate, active investors cannot outperform passive investors. This applies to any time period.

Thursday, June 4, 2009

How accurate is the Dow?

I blogged about this before, and more I think about it, I think there must be a market for a pure buy and hold mutual fund.

NC Pension fund expanding investment opportunity

Wednesday, June 3, 2009

Student evaluations

I was just re-reading some of my comments from the spring, and one from my MBA investments class struck me as particularly good..

[professor is] wise enough to know that he can never know enough and that his trade is not as well mapped out as he would like it to be...I think that this comment is relevant to all who work in investments - and in fact to life in general...

Thursday, May 28, 2009

Loss contingent capital structure?

Wednesday, May 27, 2009

Raleigh is top 10 again

GM and Ch 11. What a surprise.

Gloom and Doom...

Monday, May 25, 2009

Saturday, May 23, 2009

Cap and Trade

Unfortunately there is slim hope for a pigou tax.

Wednesday, May 20, 2009

Violating APR part 2

My prediction has come true. George Schultze, manager of Schultze Asset Management LLC says:

Don’t lend to a company with big legacy liabilities or demand a much higher rate of interest because you may be leapfrogged in a bankruptcy.

Tuesday, May 19, 2009

NASDAQ Marketsite

Put options as portfolio insurance

wolfram alpha

Check out some examples. The option valuation and time value of money tools are just fantastic alone.

Thursday, May 14, 2009

Violating APR

Deviations from APR are in fact common when a lower ranked claimant is able to extract a concession from a higher claimant, but usually these are matters that occur between two private groups. By dictating the deviation in favor of the auto workers union, the Government is, in effective authorizing a wealth transfer from the bond holders to the union. Had the bond holders known that this was likely, they would have probably not lent money on the terms they did.

Going forward, this is bad policy, because any rational bond holder will be reluctant to lend to a large unionized company because of the risk that their claim will get trashed by the Government in the event of bankruptcy. For example, who is going to lend to GM in the future?

HT: My friend Jeff.

Friday, May 8, 2009

Three Lessons from Buffet

Buffett: False precision leads to Long Term Capital Management. It only happens to people with high IQs. Those of you with an IQ of 120 are safe.

Munger: Some of the worst business decisions I’ve ever seen are the consequence of complex calculations and projections. They do that in business schools because, well, they have to do something.

Academia in France

Some of the quotes in the article are priceless and demonstrate just how utterly clueless some of those in French academia are ...

"Competition is just a right-wing ideology - in the case of humanities, competitiveness doesn't even make any sense," says Sorbonne English Professor Barbara le Lanand

Thankfully here in the US, we have a highly competitive academic system which competes not only for the best students, but also for the best faculty and the best practices."We have a republican conception of universities," explains Sandra Nossik, a student who has now spent eight years in the French university system and who was demonstrating last week in a Paris train station.

"They have to be open to everyone," she added. "We don't like this neo-liberal view of knowledge... and we don't want to have to answer to the government or businesses."

Thursday, May 7, 2009

What do Finance Professors think the equity premium is?

I actually participated in the survey and I think I said 6%. Of course more recently, the premium has certainly been higher, although before the credit market problems, I think it was headed lower than 6%.

If it is 6%, then what does this mean? Well, if the long term bond rate is about 3%, then the expected return on large cap stocks should be about 9%.

I have no idea whether or not 6% is the right number, but I am pretty sure about is that at current bond rates, a long term expected return on stocks of 12% (the historic nominal mean) is delusional.

The difference between 12% and 9% is massive.

$1000 per month for 30 years at 9% will grow to $1,830,743. While the same investment at 12% will grow to $3,494,964. Of course this assumes that the investment doesn't grow. The point is that if your financial plans are based on 12%, then you better hope that your kids are smart, because you're going to have to rely on them to pay for your retirement!

Wednesday, May 6, 2009

Monday, May 4, 2009

News Flash: Technical Analysis doesn't work

This article summarizes nicely the recent performance of various technical trading strategies...

A nice quote - technical analysis is.. "the fastest way to lose money".

Deafult spreads approaching more normal levels

Friday, April 24, 2009

S & P earnings...Fama and French comment

Fama and French have weighed in and argued that they use the method used by S&P, which in "normal" circumstances probably makes sense. But I disagree with them on this comment...

The S&P 500 is not a giant conglomerate. If a massive firm goes bankrupt and posts massive losses that outweigh it's market value, those losses are not absorbed by the other firms in the index as in a conglomerate. Once the firm has zero value, that's it. The losses are then absorbed by the creditors.

It is easy to see the logic if you imagine merging all of the firms into one giant conglomerate. The new firm's earnings and market equity are just the sum of the individual firms' earnings and market equity.

Thursday, April 23, 2009

LTCM - an insider's view

Excellent stuff.

Indexing wins, again.

Whether you should be in large cap stocks or not is based on your risk tolerance and overall asset allocation. But what is clear, time and time again, is that you should not pay anyone to actively manage your large cap portfolio. Just index, or buy and hold.

Tuesday, April 21, 2009

Market timing

Wednesday, April 15, 2009

Taleb - your 15 minutes is up

Ratings agencies become more irrelevant...

Monday, April 13, 2009

Jeremy Siegel responds...(on S&P's P/E ratios)

Finally Siegel himself has re-entered the fray and confirms what I thought he was saying. Furthermore, he has enlisted Robert Schiller who also supports his arguments.

No doubt, S&P will still argue that Siegel's arguments are without merit, but I think that this issue is closed. Not value-weighting historical earnings of companies that loose huge amounts of money causes the stated earnings of the S&P 500 to be too low. The argument made by S&P that the index is just like a multi-division company is just plain stupid.

Why active managers underperform..

The basic idea: Only about 1/5 of stocks are actually significant winners. Most don't do too much. A completely passive approach to picking stocks uses an equal weighted method and will put at least some money in the unknown "winners". But most active managers don't equally weight, and weight more heavily in their "expected" winners. As they (the active managers) don't actually have any stock picking skill, there is a good chance that there overweighting is in stocks that will underperform (i.e. they overweight in the 4/5 that don't do too much).

This relates to my recent post on the re-jiggering of the Dow and S&P 500. More I think about it, it seems that rather than index funds, folks should invest in randomly generated "buy and hold" funds. Which of course, are not available in most retirement plans.

Wednesday, April 8, 2009

Conflicts of interest. A case study....

Ah, good old circular conflicts of interest. To summarize: i) Merrill, which is probably not too happy with having loaned Kimco $707 million on its credit facility, underwrites a $720million (including a 15% overallotment) stock offering for which it gets $20 million, ii) Merrill's analyst changes the stock from a Sell to a Buy, causing it to pop 30% in one day, and allegedly allowing participants in the offering to sell their shares at a 30% gain in a day, a mindblowing annualized return, iii) Kimco uses the proceeds to repay Merrill's credit facility, cleaning out any credit risk exposure Merrill might have with respect to Kimco's underperforming properties and operations.

It makes my head hurt. I'd say that this kind of stuff gives Wall Street a bad name, but I think it's too late.

Monday, April 6, 2009

How Dow Jones and SP mess things up

The components of both indices change when a stock drops out and is replaced by a new stock and the new addition is invariably some hot growth stock that has seen a rapid run up (i.e. MSFT, GOOG, Yahoo etc) and the stock that is dropped out (particularly in the Dow) is a value stock. So, in effect, the indices buy growth stocks when their values are high.

Indexing is great because it reduces the cost of active management. But as this article shows, there is still the active management of the index creator that can mess things up for you.

MM homemade leverage and hedge funds

Hedge funds make bets on securities and also lever up. On Portfolio.com there is a nice posting talking about why hedge fund managers shouldn't use leverage, and why hedge fund investors should choose the level of leverage that they desire.

It's a nice example of an application of capital structure irrelevance.

Wednesday, April 1, 2009

Searching for value

The Federal Debt and Retirement Planning.

The problem is two fold. First, our legislators have continued to expand these programs, because the programs are popular (and the legislators want to be popular as well). Second, the ratio of workers to beneficiaries continues to fall. Fewer people are paying in to the system relative to those drawing out of the system.

This is not really my area of expertise, but it seems that there are two solutions: Raise taxes or cut benefits.

In my personal retirement planning both of these will impact me (and most people) directly. First, higher taxes in the future means that I have uncertainty as to the value of my retirement portfolio which is made of pre-tax dollars. When I retire, I will have to pay taxes on these funds, and higher future tax rates will hurt my wealth. Second, part of my retirement will be funded by social security. It seems clear that the growth of these benefits will have to be curtailed, and when these benefits are paid will have to be delayed.

These two possibilities suggest that 1) it might make sense to put cash in a Roth IRA where the taxes are paid up front. This will reduce the "tax risk". 2) Lower benefits means that I will either need to put more away, or expect a lower standard of living when I retire.

Another question is whether the traditional retirement portfolio of mostly stocks is prudent. Zvi Bodie (one of the authors of the leading MBA investments text) argues that we have it all wrong in asset allocation for retirement. Rather than buying stocks, we should buy TIPs (Treasury Inflation Protected Securities). I'll write a blog post on his ideas in the near future.

In the meantime, it seems pretty unambiguous that we need to save more.

Monday, March 30, 2009

Thursday, March 26, 2009

B. School Profs say publishing in finance is the hardest.

One question asked "which field, apart from your own is the hardest to publish in?" All the other areas; Accounting, Marketing, Management, Operations etc on average said that "Finance" was the hardest discipline to publish in.

The study went on to explore why this is so. A couple of reasons were offered - there are fewer finance journals that are considered "A"s compared to other fields and the acceptance rate at these journals were lower.

I need to remember to leave a copy of this article on my dept head's desk! But in the meantime I better get back to trying to get my papers published....

Active vs Passive Management...Mutual Funds

On their blog they summarize their findings....

Our new paper, Luck versus Skill in the Cross Section of Mutual Fund Alpha Estimates, takes another look at the performance of mutual funds. Bootstrap simulations produce no evidence that any managers have enough skill to cover the costs they impose on investors. If there are managers with sufficient skill to cover costs, they are hidden among the mass of managers with insufficient skill.Yet more evidence against buying funds with active management fees. If you are investing for the long run you can basically control two things. Diversification and fees. So buy well diversified index funds.

What's going on with inflation?

I recently posted an article on the Poole College Thought Leadership page titled: " What's going on with inflation?" . This w...

-

There are a lot of similarities between the boom and bust of the Beanie Baby market in the 1990s and booms and busts in financial markets. ...

-

Another inflation illusion post. This time with math. Again the issue here is that you can't just increase the discount rate when you a...

-

I recently posted an article on the Poole College Thought Leadership page titled: " What's going on with inflation?" . This w...